A perfect storm of economic and regulatory challenges has created the worst environment for new construction in nearly 80 years, according to one prominent Chicago developer who sees alarmin...

Traditional banking systems assume steady paychecks and salaried employment. For nearly half of the professional workforce in the United States, that assumption simply doesn’t hold.

“Financial services are built for the salaried professional and the companies that employ them. This presents significant challenges, as 46% of the professional layer of our economy is self-employed,” explains Brandon Wright, Co-founder and CEO of Tongo, a financial services platform designed specifically for real estate agents and other self-employed professionals.

In real estate and other commission-based industries, income often comes in large, unpredictable bursts, making it difficult to plan, budget, or access credit through conventional means. Tongo aims to ensure that financial services meet the needs of professionals who work outside the standard paycheck model.

The average real estate agent closes approximately five deals per year, earning just under $80,000 annually. However, this income arrives unpredictably, creating a fundamental misalignment with monthly expense cycles.

“All of your expenses are monthly, under the impression that you get paid probably twice a month,” Wright points out. “But the average real estate agent’s income isn’t necessarily aligned at all with the 12 expense cycles when your expenses are due every month.”

This misalignment creates significant financial stress. Without steady income, agents often turn to credit cards to bridge the gap between commissions. According to Wright, “If you look at the credit card balance of the average American, they tend to have 3.9 credit cards with about a $10,000 monthly balance. If you look at the credit card balances of the average real estate agent, they have 50% more credit cards and about two and a half times the balance.”

This isn’t due to financial irresponsibility, Wright emphasizes. Rather, “What’s actually happening is they’re trying to manufacture a business line of credit from their personal credit products, because they don’t typically qualify for low-cost lines of credit.”

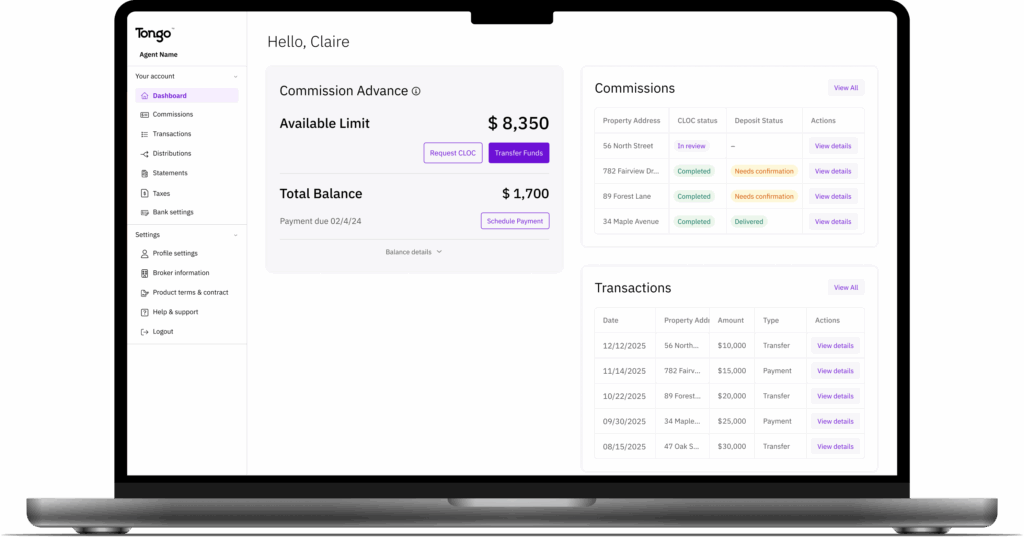

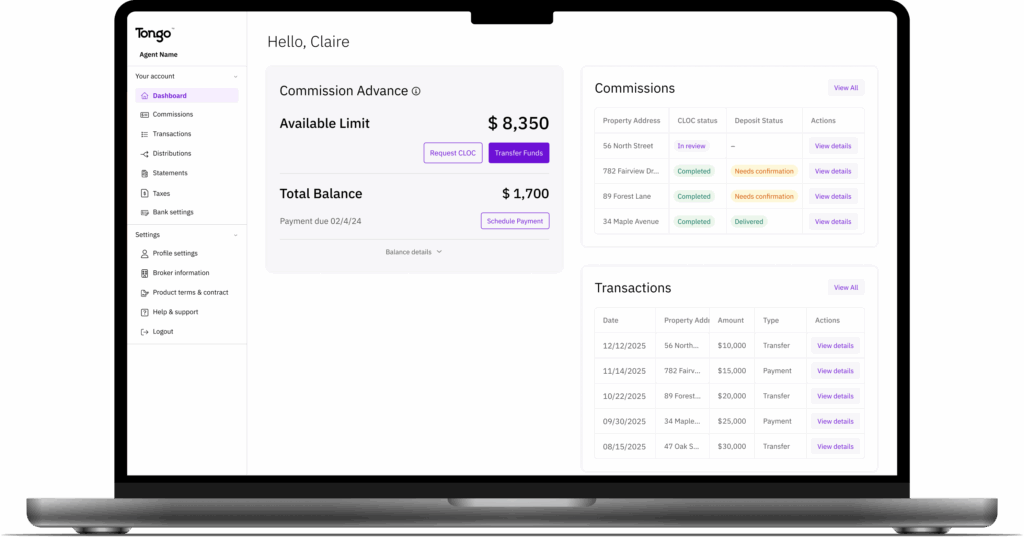

Tongo’s solution begins with a fundamental reimagining of how financial services should work for self-employed professionals. The company has created a comprehensive platform that includes:

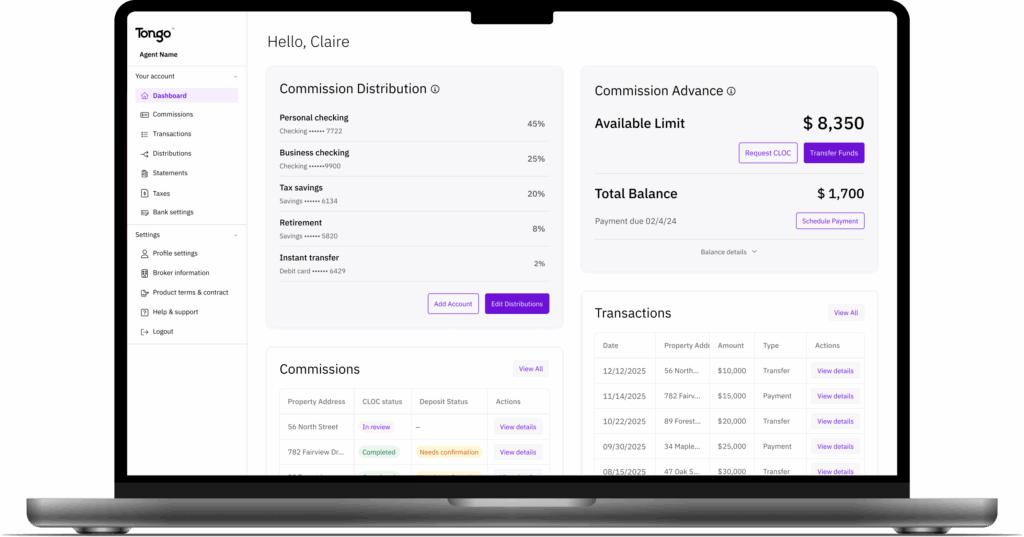

“Let’s build the first line of credit that they don’t have to repay until they get paid,” Wright explains. “Let’s price it like a credit card so that it’s rationally priced. Let’s build in a lot of flexibility so that it doesn’t cost anything unless you use it.”

This approach addresses the fundamental cash flow challenges that self-employed professionals face. But Tongo goes further by creating a comprehensive financial ecosystem.

“For a broker, let’s just build a product that feels like direct deposit. But for an agent, the experience is radically different,” Wright says. “Now they can connect up to 20 accounts to Tongo, and then from their dashboard configure: I want X percent to go to my business checking, Y percent to go to my high-yield savings, which is where I set aside money for taxes, because I have to pay those on my own. I’m going to kick 5% into my SEP IRA or solo 401(k), because that’s where I’m going to save in a tax-efficient way.”

Tongo recently announced a significant partnership with Anywhere Real Estate, one of the largest real estate companies in the United States. This partnership will make Tongo’s financial tools available to agents affiliated with brokerages owned or franchised by Anywhere.

The partnership represents a significant validation of Tongo’s approach and signals a broader shift in how brokerages are thinking about agent retention and support.

“What’s interesting about the opportunity that we’re pursuing now is that we’re kind of leapfrogging,” Wright notes. “The interest that we’re getting is from these enterprise relationships.”

According to Wright, the brokerages most interested in Tongo’s solutions share certain characteristics: “They tend to be aggressively looking for new technologies that will empower their agents. They tend to be agent-centric… They want to invest in their agent population. They are less transactional.”

The partnership with Anywhere reflects a broader trend in the real estate industry: brokerages are rethinking how they provide value to agents beyond just brand affiliation and commission splits.

“The average commission split was something like 70-30, and then you update it the next year, and it’s like 75-25, and you update it the next year, it’s like 80-20,” Wright explains, describing the industry’s race to offer agents higher commission splits.

But this approach is unsustainable. “That’s a race to the bottom,” Wright says. “Brokerages now that have all of this fixed cost in decades and decades of brand and recognition are trying to figure out, ‘What can we do to attract and retain the best agents that is different than just offering you more of your split?'”

The answer, according to Wright, lies in providing integrated solutions that help agents build successful businesses. “How can we actually help you? How can we do the work in this very noisy marketplace of solutions, to actually find the best tools in each category and then package them up, hopefully in an integrated way?”

Looking ahead, Wright sees opportunities to expand Tongo’s impact beyond just providing financial tools. By managing the flow of funds between brokerages and agents, Tongo can generate valuable business intelligence that has been lacking in the industry.

“Because we can see all that money moving through the pipeline, we can actually start measuring and quantifying and surfacing these really interesting insights to brokerages that they’ve never seen before,” Wright explains.

For example, brokerages may not have clear visibility into which agents are consistently performing well beyond their top producers. “If you were to ask a brokerage, ‘Which agent is consistently your fourth best producing agent?’ They may not know,” Wright says. “These people who are just consistently showing up, doing great business, creating a bunch of value for the brokerage—they may not be getting the awareness, the recognition.”

By providing these insights, Tongo can help brokerages make more informed decisions about how to invest in their agent population.

While Tongo is currently focused on serving real estate professionals, Wright sees potential to expand to other self-employed sectors in the future. The fundamental challenges of income volatility and financial planning affect many self-employed professionals beyond real estate.

“Whatever’s happening in real estate, we’re super excited about taking that to other verticals,” Wright says, though he acknowledges “it’s going to take a little bit of time.”

For now, Tongo is focused on building what Wright calls “verticalizing this financial layer,” creating a comprehensive suite of financial tools specifically designed for the unique needs of real estate professionals.

Every month we conduct hundreds of interviews with

active market practitioners - thousands to date.

Explore similar articles from Our Team of Experts.

A perfect storm of economic and regulatory challenges has created the worst environment for new construction in nearly 80 years, according to one prominent Chicago developer who sees alarmin...

Todd Cover, President & CEO, Belmont Savings Bank CEOCFO and Belmont Savings Bank (BSB) President & CEO, Todd Cover discuss Doing What’s Best for Their Customers and Keeping Money ...

Remote workers are fundamentally transforming Montana’s rural real estate landscape, with properties offering substantial acreage and outdoor amenities seeing unprecedented demand, acc...

TORONTO, Oct. 07, 2024 (GLOBE NEWSWIRE) — Nexus Industrial REIT (“Nexus” or the “REIT”) (TSX: NXR.UN) is pleased to announce the appointment of Mary Vitug to the Board ...

The South Florida luxury real estate market is experiencing a clear bifurcation, with the $2-5 million segment showing resilience while other price points face challenges, according to an ag...

A notable migration trend is transforming Orlando’s luxury real estate market, with California buyers increasingly opting for Central Florida over established high-end destinations lik...