Former Climb Real Estate founder and now a CEO of Highnote, Mark Choey argues that despite AI advances, real estate transactions remain fundamentally human-driven, requiring trust that techn...

Title Search Technology Advances in the Data-Driven Real Estate Industry

“People have been working on instant title searches for 25 years. The race is on to do an instant search, with underwriters well-positioned because they own all the data, and data is king,” says Erich Wiedel, President of Mortiles, describing the technological competition reshaping the title insurance industry.

The title insurance sector, traditionally methodical and paper-heavy, is undergoing significant technological advancement. With annual risk exposure mitigation of $600 to $900 billion and Q1 2024 premiums reaching $3.35 billion, the industry faces increasing pressure to innovate while maintaining the accuracy that property owners and lenders depend on.

The Quest for Instant Title Searches

The ultimate goal of title insurance technology has long been the instant title search—a comprehensive property history verification completed in seconds rather than days. This objective has driven substantial investment in artificial intelligence, machine learning, and sophisticated data management systems.

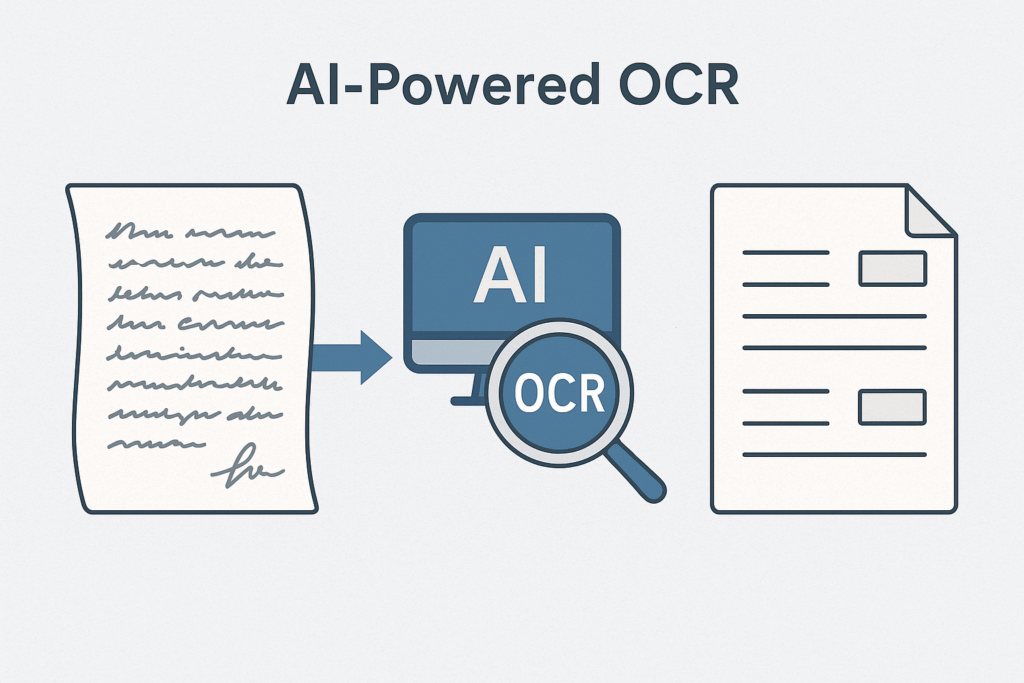

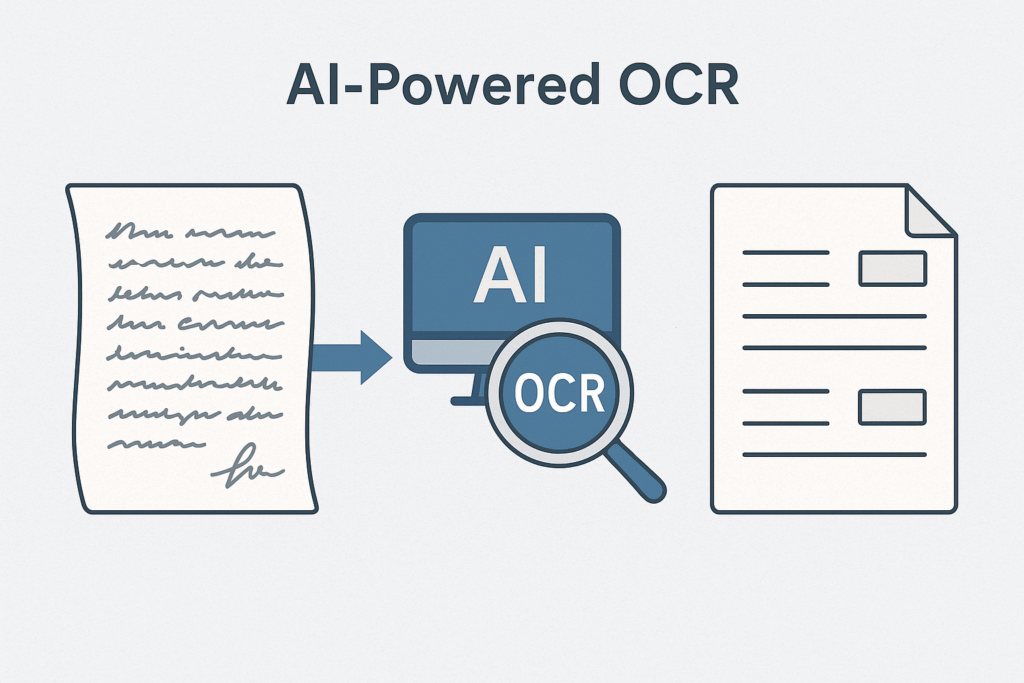

“AI-powered OCR can now extract data from handwritten documents from 100 years ago, or even poorly handwritten documents created today,” Wiedel explains, noting how modern technology addresses one of the industry’s persistent challenges: digitizing and interpreting historical records that often exist only in paper form.

Despite significant advances, the technology remains in development. “The technology is currently handling about 35% of the job, but we’re aspiring to reach a 50/50 balance with human oversight,” says Wiedel of their own operations. This approach acknowledges that while automation can manage routine tasks, human expertise remains essential for interpreting complex title issues and ensuring accuracy.

Data Ownership as Competitive Advantage

As the industry moves toward faster, more efficient title searches, a critical competitive advantage has emerged: data ownership. Title insurance underwriters who have accumulated decades of property records, transaction histories, and risk assessments possess a valuable asset that new market entrants cannot easily replicate.

Established underwriters have a significant competitive advantage through their ownership of extensive historical data repositories that enable them to build more effective predictive models and automated capabilities.

This data advantage explains why traditional title insurance companies remain competitive despite challenges from tech startups and alternative models. The industry’s institutional knowledge, embedded in both human expertise and proprietary databases, creates a barrier that technology alone cannot easily overcome.

Predictive Underwriting: Promise vs. Reality

One of the most discussed technological approaches in recent years has been predictive underwriting—using data analytics and machine learning to assess title risks more quickly and accurately. While promising in concept, the real-world impact has been modest.

“The predictive underwriting trend has been significant, but it only saved one day off the average loan closed cycle, according to some studies,” Wiedel points out, moderating expectations about how quickly these technologies will change the industry.

This incremental progress reflects the complexity of title insurance, where even small improvements in efficiency can yield significant benefits across millions of transactions, but major change faces substantial hurdles in an industry where accuracy is paramount and errors can have costly consequences.

Blockchain: Hype Meets Reality

Among the technologies generating attention in the title space, blockchain has perhaps created the most speculation about industry disruption. “Blockchain technology in the title space caused nervous shockwaves because some believed it could replace title insurance, but it hasn’t materialized as expected,” Wiedel notes.

The theoretical promise of blockchain—creating an immutable, transparent record of property ownership that eliminates the need for traditional title searches—has yet to overcome practical implementation challenges. These include the massive task of migrating historical records, varying state and local recording systems, and regulatory frameworks designed around the existing title insurance model.

Nevertheless, the industry is exploring blockchain applications that complement rather than replace traditional title insurance. “We’re excited about partnering with blockchain experts who have moved from the private sector to enhance the real estate industry with their technology,” Wiedel shares, suggesting that collaborative approaches may yield more immediate benefits than disruptive ones.

The Economic Reality: Who Pays for Innovation?

Beyond the technical challenges of implementing new technologies, the title insurance industry faces a fundamental business question: who will bear the cost of innovation?

“Many solutions tech people are developing offer potential, but the question remains: who is going to pay for these technologies?” Wiedel asks, highlighting the economic reality that shapes technology adoption in the industry.

With margins already under pressure from economic conditions and competitive forces, title companies must carefully evaluate technology investments against their potential return. This economic calculation, more than technical feasibility, often determines which innovations gain traction in the marketplace.

The Path Forward: Human Expertise Enhanced by Technology

As the title insurance industry continues its technological evolution, the most successful approaches will likely combine the efficiency and scale of automation with the judgment and expertise of human professionals. The goal is not to eliminate the human element but to enhance it, allowing title professionals to focus on complex issues while technology handles routine tasks.

“The adoption of new technologies in the title industry is a gradual process, similar to going to the gym, where you don’t see results immediately,” Wiedel explains, cautioning against expectations of rapid transformation.

With annual premiums in the billions and responsibility for securing trillions in property transactions, the title insurance industry has both the resources and the motivation to invest in technological innovation. The pursuit of instant title searches continues, driven by data ownership and competitive pressures, but guided by the industry’s commitment to accuracy and reliability.

The future of title insurance will likely be defined by the thoughtful integration of multiple technologies, each contributing to a more efficient, accurate, and responsive system for verifying and insuring property ownership.

This article was sourced from a live expert interview.

Every month we conduct hundreds of interviews with

active market practitioners - thousands to date.

Similar Articles

Explore similar articles from Our Team of Experts.

Commercial real estate has a communication problem. The industry is awash in PropTech solutions, AI promises, and digital transformation rhetoric – but most property owners and operato...

KLAUS Multiparking America is advancing urban development with the launch of their latest innovation, the kVario 8000 Series Semi-Automatic Puzzle Parking System. This breakthrough technolog...

“Technology adoption in real estate operations has been traditionally slow, so you have to make it so easy that anyone can do it,” explains Tiffany Mittal, Founder and CEO of Uti...

Landings has introduced a new approach to address the infrastructure shortage facing electric aviation, according to CEO Lisa Wright. In a recent interview, Wright outlined how the company�...