The Beshara Teams New Agents: Eli Estanga, Montse Ordono, Ninel Villeda, Ebony Cooper MARIETTA, GA, UNITED STATES, September 12, 2024 /EINPresswire.com/ — The Beshara Real Estate Team,...

Belmont Savings Bank (BSB) President & CEO, Todd Cover Discusses How They Grew Their Loan Portfolio to $300 Million

CEOCFO and Belmont Savings Bank (BSB) President & CEO, Todd Cover discuss Doing What’s Best for Their Customers and Keeping Money in Their Communities

ST. CLAIRSVILLE, OHIO, USA, July 3, 2024 /EINPresswire.com/ — CEOCFO Magazine, an independent business and investor publication that highlights important technologies, companies, financial and lending institutions, today announced an interview with Todd Cover, President & CEO of Bellaire, Ohio-based Belmont Savings Bank (BSB), with branches and providing services in St. Clairsville, Ohio, Wheeling, WV, Barnesville, Ohio, Moundsville, WV, Powhatan Point, OH and the surrounding Ohio Valley area.

To read the full interview visit:

https://www.ceocfointerviews.com/belmontsavingsbank24.html

Want to know what customers as saying about BSB? Watch Video Now:

https://youtu.be/6BKfXoNxeK4

During the interview with CEOCFO’s Editorial Executive Bud Wayne, giving us a look at how BSB maintains that community bank feel with so much change in banking occurring over the last 9 years, Mr. Cover said, “A lot has changed in banking and our niche has always been being a community partner. We are not here to just sell or push products and make money for us, it is about truly doing what the customer needs and how we can help the customers. We have turned deals away because it was not what was in the best interest of the customers which is very unusual for many of banks.”

On transitioning from an investment bank model to a commercial/business lending bank, Mr. Cover told Bud, “Being an investment bank there is not much interaction with the community so I think for us to get out and be a true banking partner means lending into our communities to help people finance projects, education, houses, and cars, and being a community partner. That is the sole purpose of a community bank. One of the things we do, and people recognize us for, is donating to community projects and participating in fundraisers.”

When asked about the growth of their loan portfolio, Mr. Cover offered, “Despite what is going on with the economy we have grown that closer to $300 million. I think we are at $292 as we sit here today. Therefore, the growth has continued. The interest rate environment has slowed down our mortgage lending. However, our commercial lending has picked up lots of steam.”

In commenting on industries important to their loan portfolio, Mr. Cover remarked “We are still pretty much real estate heavy. Maybe closer to 90% of our real estate portfolio is real estate secured. I have read several articles about troubles in real estate lending, especially on the commercial side but for us, it is about being conservative. We do not make any quick and impulsive decisions. We sit down and discuss whether a project makes sense if the market is valuable enough, and whether we are still being conservative. We keep our real estate lending margins within our comfort level. We have a conservative lending team, so I am not concerned about it.”

As for why potential customers should consider BSB, Mr. Cover said, “We are a relationship bank; we are going to do what is best for you. We are not out to make a buck off you, but here to help you accomplish your goals. It is a combination of local decision-making and the ease of doing business with us. You are going to talk to a ‘live’ person every time you call here. When you add all those things together you will see that BSB is the bank for you.

“Something else that is very important is that when you are doing business with us and putting money in a deposit with us, it is going back to the local community. It is not going to Columbus, Cleveland, or Cincinnati. It is going to stay here in the Ohio Valley. A lot of people overlook that and think they can get it cheaper somewhere else, but that money is not staying local so it does not help grow your communities. For example, it will not help your neighbor finance his truck. It is going to one of the bigger cities. That is an overlooked point as well about community banking.”

Read the full interview:

https://www.ceocfointerviews.com/belmontsavingsbank24.html

Find out what customers are saying about BSB – Watch Video Now:

https://youtu.be/6BKfXoNxeK4

Bud Wayne

CEOCFO Magazine

+ +1 727-480-7070

[email protected]

What customers as saying about BSB | Belmont Savings Bank | St. Clairsville, Ohio, Wheeling, WV, Barnesville, Ohio, Moundsville, WV, Powhatan Point, Ohio Valley

[embedded content]

This article was sourced from a live expert interview.

Every month we conduct hundreds of interviews with

active market practitioners - thousands to date.

Similar Articles

Explore similar articles from Our Team of Experts.

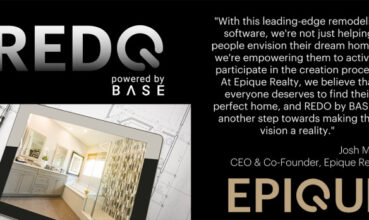

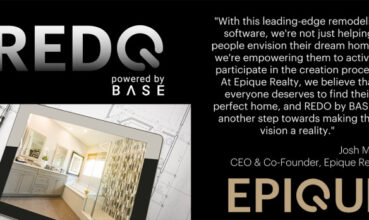

REDO powered by Base revolutionizes real estate showcasing and customization. Online, August 9, 2024 (Newswire.com) – REDO by BASE is a sophisticated and innovative simulation software...

Sacramento real estate leader Johnny Jennings says the traditional ‘three P’s’ approach to selling homes, ‘put a sign in the yard, put it on MLS, and pray,’ is ...

As fears of market disruption drive some real estate professionals to exit the industry, one expert sees striking parallels to 2008, and the opportunities that emerged from that crisis. Dani...

Celebrate the groundbreaking of the new US Quality Construction. US Quality Construction’s investment in the community. US Quality Construction is a leader in home renovation. Celebrating ...