NAPLES, Fla., July 01, 2024 (GLOBE NEWSWIRE) — Premier Sotheby’s International Realty is pleased to announce that Adam Kaufman has joined the company’s leadership team as senio...

Pet-Friendly Insurance Adapts to America's Animal-Loving Renters

“There is a significant number of people across the nation renting, and the correlation between people who rent and own pets is very evident,” observes Andrés Mishaan, Co-Founder and CEO of Kanguro. This intersection represents one of the most significant yet underserved segments in the insurance market today.

The numbers tell a compelling story: 59% of renters reported having at least one pet in 2023, while pet ownership across all U.S. households has climbed to 66% in 2024. This shift has created both challenges and opportunities for insurers, property managers, and renters alike.

The Changing Landscape of Renting with Pets

The traditional assumption that homeowners are more likely to own pets than renters no longer holds true. Pet owners now make up the majority of the rental market, creating a fundamental shift in how property managers approach their policies and how insurance companies structure their offerings.

“We thought that having a culture-specific understanding of what this market expects was a significant competitive advantage for us,” Mishaan explains, noting how insurers who recognize and adapt to this demographic shift are positioning themselves for growth.

This evolution comes at a critical time. As rental costs continue to rise in many markets, pet owners face additional financial hurdles in the form of pet deposits, monthly pet rent, and potential liability concerns. These factors have created a market ready for innovation in the insurance sector.

The Financial Stakes of Pet Ownership for Renters

The financial implications of pet ownership extend far beyond monthly food costs and veterinary care. For renters, the liability aspects can be particularly significant.

In 2023, the average dog bite claim cost over $58,000 – a sobering statistic that underscores why insurance coverage is essential for pet owners. Standard renters insurance policies often include liability coverage for pet-related accidents, but many renters remain unaware of this protection or its limitations.

“It’s a mix of educating the consumer, providing good value, and recognizing that people often have a moment of realization when they’re moving,” notes Mishaan.

Many renters don’t realize that their policy might exclude certain breeds or that additional coverage might be necessary for specific situations. This knowledge gap creates vulnerability for renters and opportunity for insurers who can effectively communicate these nuances.

The Landlord Perspective: Mitigating Risk While Attracting Tenants

Property owners and managers find themselves balancing competing priorities: attracting the widest possible pool of qualified tenants while protecting their investments from potential damage or liability.

This balancing act has led to an important development: landlords can require tenants to purchase pet insurance or renters insurance with specific pet liability coverage. This approach allows property managers to be pet-friendly while mitigating their financial exposure.

“For me, the return on investment is customer lifetime value, so you have happy clients that you will retain,” Mishaan points out. This perspective applies equally to landlords, who benefit from longer tenancies when they accommodate pet owners in a financially sustainable way.

Forward-thinking property management companies are now partnering directly with insurance providers to offer streamlined coverage options for their pet-owning tenants, creating solutions that protect all parties while simplifying the rental process.

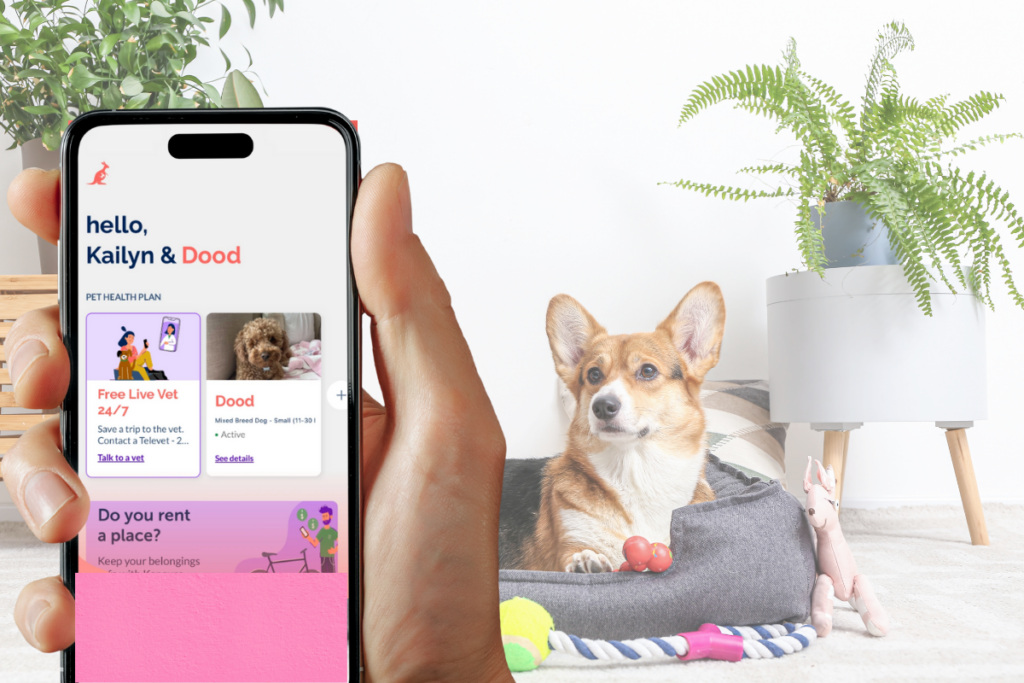

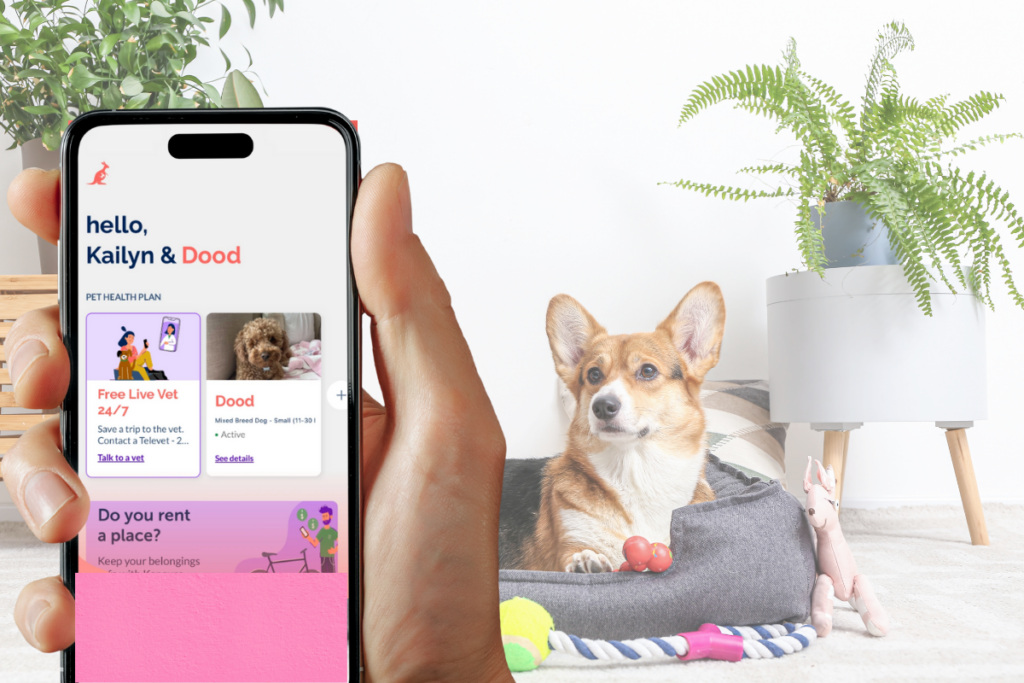

Technology and Innovation in Pet-Friendly Insurance

The insurance industry’s approach to serving pet-owning renters is advancing quickly, with technology playing a central role in this development.

“We thought it was smart to just use AI… but then we realized that it’s actually frustrating for many people who get to a certain point with the interaction,” Mishaan shares, highlighting the industry’s learning curve when balancing technological efficiency with human connection.

Innovative insurers are developing more nuanced approaches that leverage technology while maintaining the personal touch that complex insurance decisions often require. Mobile apps that simplify claims processes, AI-powered risk assessment tools that provide more accurate pricing, and educational resources that help renters understand their coverage are becoming competitive differentiators.

“Our biggest priority was to get the experience to how we imagined it because we are the new generation of insurance companies and banks,” explains Mishaan. This focus on user experience represents a significant shift from traditional insurance models.

The Future of Pet-Friendly Renting

As the pet-owning renter demographic continues to grow, forward-thinking insurers who offer tailored, user-friendly coverage will lead the industry. This evolution benefits everyone: renters gain protection, landlords reduce risk, and insurers tap into an expanding market—creating a rental landscape where both people and pets can find their perfect home.

This article was sourced from a live expert interview.

Every month we conduct hundreds of interviews with

active market practitioners - thousands to date.

Similar Articles

Explore similar articles from Our Team of Experts.

Chicago’s south and southwest neighborhoods are facing a sharp correction as speculative development during the pandemic era collides with rising property taxes and stagnant rents. Kevin R...

The multifamily housing market is facing a severe and potentially long-lasting supply shortage that could reshape the industry, according to Jason Yarusi, Managing Member of Yarusi Holdings,...

The Alexandria rental market is experiencing an unexpected surge in competition, with smaller units emerging as particularly hot commodities, according to local real estate expert Hope Peele...

Hotel Operations Co., a Colombian boutique hotel developer and operator, is seeking to reshape how boutique hospitality functions in emerging tourism markets, according to General Manager Ma...