A surge in new construction is forcing existing home sellers to significantly adjust their pricing strategies in Central Florida, according to Michael Dorman of Elevate Real Estate Brokers, ...

Building, an Internationally Compliant Platform for the Tokenization of Real Estate and Other Financial Assets, is Creating Data-Driven Assets for Smarter Portfolios

MILWAUKEE, June 5, 2024 (Newswire.com) – Building, a technology startup incorporated in the United States and with incorporation beginning in Hong Kong, announced its flagship product for institutional-grade tokenization of real estate and other financial assets. The announcement comes at a time when the tokenization of “real world assets” has caught the attention of many individual and institutional investors as a more efficient, and potentially liquid, means of investing into alternative assets like commercial real estate.

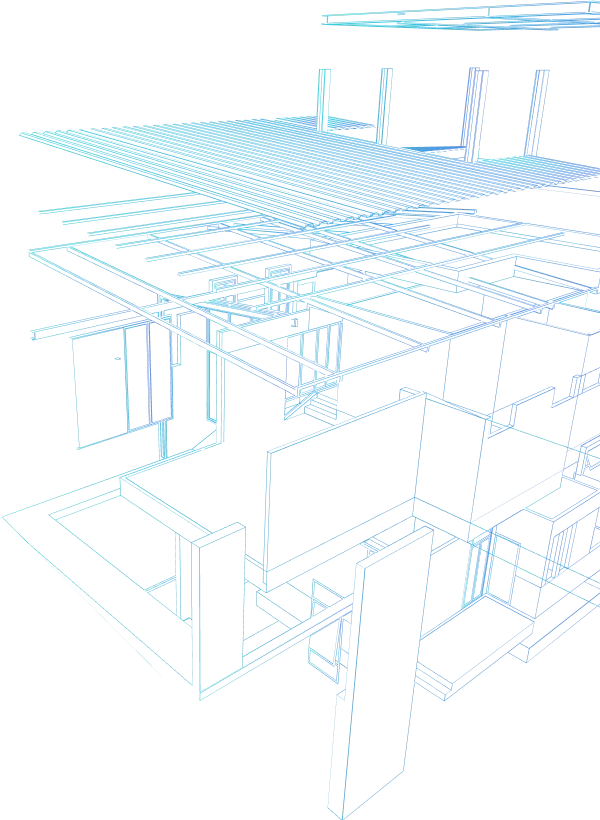

The company says it has a unique and strategic approach to digitizing an asset’s ownership and data with blockchain, a process known as tokenization. “We believe that the digitization, securitization, and eventual tokenization of a real estate asset begins at the property’s ideation,” said Matthew Schneider, Building’s CEO. “Valuable real estate information is present in the very beginning, during pre-construction, through construction, going to market, and then needs to resurface during refinancing or the sale of the asset.”

Building sets itself apart with its immutable, perpetual collection of property data. “Using the blockchain to create what’s essentially a fingerprint for every digitized document, we can provide data provenance, a very important step in increasing trust and transparency in real estate investments. Stakeholders want to know where data is coming from, who it’s been handled by, and how recently it was updated. From there, we can use computation and experience to assess its accuracy.”

Infrastructure for a Tokenized Future

Institutional investors and asset managers are eager to tokenize their financial assets, with use cases spanning from artwork to luxury hotels. The interest stems from tokenization’s potential to increase liquidity, though there is some disagreement as to how quickly this can happen.

Schneider explains, “Tokenization doesn’t truly bring liquidity. Some asset classes are illiquid, meaning it’s hard to receive a cash value equivalent for the asset. Just because a piece of real estate is digitized doesn’t mean liquidity is present. Liquidity is created when there’s a buyer for every seller, and no one is buying if there isn’t sufficient or accurate data on the asset. This dilemma lays the foundation for everything we’ve built.”

Building’s collection and validation of real estate data provides insight into the health and performance of the underlying asset. Additionally, Building’s platform is able to procure market data, calculate financial projections, and integrate with service providers to provide a well-rounded assessment of the asset’s value. With the help of artificial intelligence, these processes can be done at scale.

Community Engagement

Building is also the Presenting Sponsor of Next Gen MKE, an event in Milwaukee, Wisconsin, that aims to bring together visionaries in experiential, educational events centered around real estate, deep tech, and social impact.

Source: Building

Every month we conduct hundreds of interviews with

active market practitioners - thousands to date.

Explore similar articles from Our Team of Experts.

A surge in new construction is forcing existing home sellers to significantly adjust their pricing strategies in Central Florida, according to Michael Dorman of Elevate Real Estate Brokers, ...

Data centers are rapidly multiplying in response to the surging demand for cloud computing, streaming, and artificial intelligence. Yet, constructing one is a complex, years-long endeavor th...

The luxury condominium market in South Florida is facing a glut of high-end supply aimed at a shrinking pool of ultra-wealthy buyers, according to Eric Scheffler, Co-Founder and Managing Par...

A New Era of Living for Today’s Active Adults TAVARES, FL, November 21, 2024 (Newswire.com) – Kolter Homes, a renowned builder of active adult communities in Florida, is excited ...

Boca Dream Island Aerial Boca Dream Island Plans Boca Dream Island is Now Available for Purchase BOCA GRANDE, FLORIDA, USA, June 17, 2024 /EINPresswire.com/ — Boca Dream Island: an ext...

The rush to implement artificial intelligence risks missing the fundamental point about technology adoption, according to one industry expert with deep experience in both AI and real estate....