The narrative around foreign investment in US real estate has been dominated by headlines about declining interest and regulatory barriers. However, companies operating in this space are exp...

Securing Real Estate Transactions: RedlineDCS Tackles Wire Fraud

Homebuyers can lose their life savings in a matter of minutes, and for many, the threat comes when they least expect it. Wire instruction fraud, a fast-growing scam targeting real estate transactions, has become one of the industry’s most urgent problems. Now, one tech founder is leveraging personal experience to deliver a solution.

“I have a knack for solving issues that others overlook,” says Jan Tomaszewski, CEO and Founder of RedlineDCS. His company, originally built to enable secure document collaboration for high-stakes business deals, is now addressing the communication gaps that make real estate transactions vulnerable to fraud. The idea took shape after Tomaszewski’s own home purchase was nearly derailed by a cascade of preventable missteps.

This experience revealed a critical vulnerability in real estate transactions. Wire fraud typically occurs when hackers intercept communications and send fraudulent wire instructions, redirecting funds to criminal accounts. Once the money is wired, recovery is nearly impossible.

A Hybrid Approach: Digital Security Meets Analog Verification

What makes RedlineDCS’s solution unique is its combination of digital and physical security measures, a strategy Tomaszewski believes is essential for truly secure transactions.

“We’ve developed a workflow that authenticates wire instructions,” he explains. “The law firm or escrow agent would be our main client, and we provide them with sealed envelopes containing specific instructions.”

The process is elegantly simple yet highly secure: When a transaction nears closing, the buyer receives a sealed envelope containing a specific URL and a number (2, 3, 4, or 5). The buyer uses the URL to create a secure virtual room and invites their escrow agent using a specific email address. The number indicates which day the wire instructions will be uploaded.

“If instructions arrive on day two when you’re supposed to get them on day three, the process stops, call your lawyer, something’s fishy,” Tomaszewski explains. “But if they arrive on the designated day, you’ll see the document appear. You review it, sign it, and your law firm receives confirmation.”

This creates multiple authentication layers that are difficult to breach. Scammers won’t know when to upload fraudulent instructions because only the buyer knows the designated day. Meanwhile, the digital platform includes multi-factor authentication, encrypted servers, and comprehensive audit logs.

“We can detect if anyone else attempts access,” Tomaszewski notes. “Only two people ever touch this room: the buyer and the escrow agent who uploaded the instructions.”

Beyond Fraud Prevention: A Complete Transaction Platform

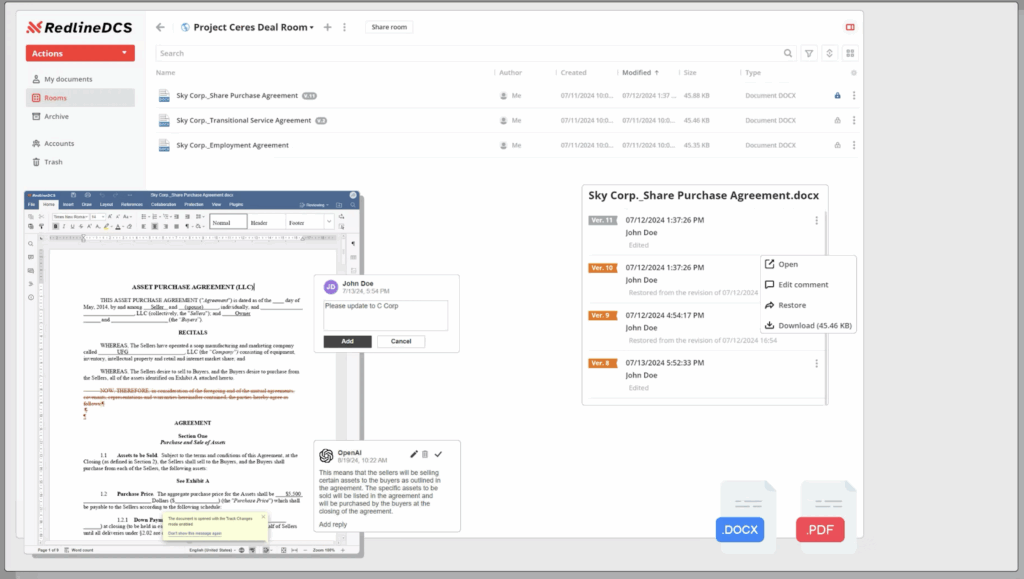

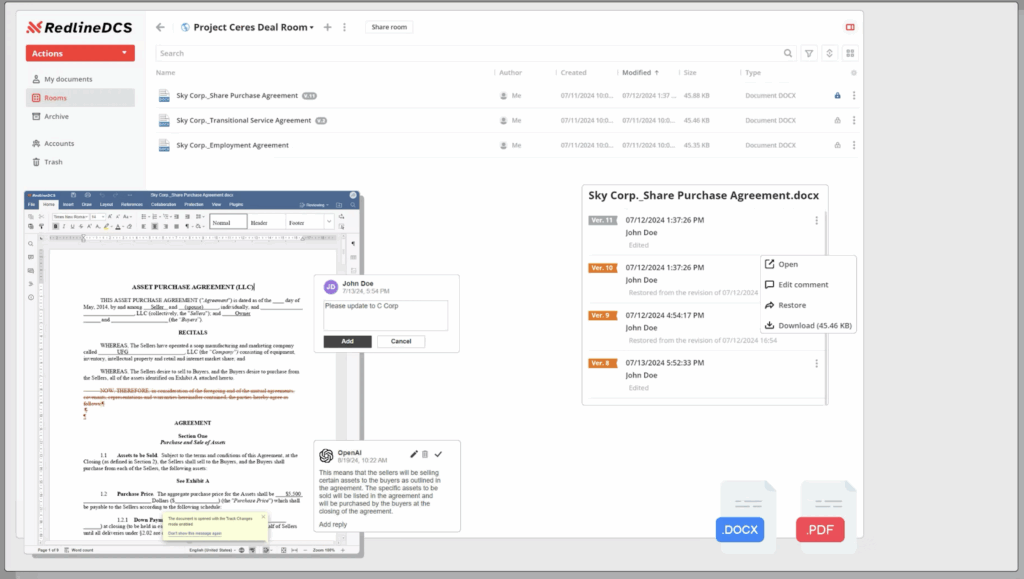

While wire fraud protection is the entry point, RedlineDCS’s platform streamlines the entire transaction process.

“If you need a virtual data room for document sharing, use ours. If contracts need signing, you don’t need DocuSign anymore. You can execute everything on our platform,” Tomaszewski says.

The system includes document editing capabilities that eliminate the need for additional software subscriptions. When one client mentioned paying $30 monthly per user just to rearrange PDF pages, RedlineDCS added the feature within a week.

This responsiveness to client needs drives the company’s growth. “Hearing about an issue and then fixing it is how we succeed,” Tomaszewski says.

Promising Early Results

RedlineDCS is currently in month two of a three-month pilot program with 15 law firms and brokers in New York. Early feedback has been encouraging.

“They report significant time savings,” Tomaszewski says. “They’re confident that this verification process saves time and money, enabling faster closings.”

The value proposition is clear: reduce paralegal overtime, eliminate temporary staffing during busy seasons, and increase closing capacity. “My philosophy is, if you provide it for free with comprehensive training and they still don’t use it, that’s an important validation marker,” he adds.

Strategic Pricing Based on Value Creation

Unlike competitors charging buyers directly (Tomaszewski mentions one solution with a $600 buyer fee), RedlineDCS aims to create value by reducing expenses elsewhere in the transaction.

“Any solution must reduce expenses somewhere in the process,” he explains. “My goal is to reduce paralegal overtime and control payroll while increasing capacity.”

For residential real estate, Tomaszewski is considering around $300-400 per month per organization, significantly less than the company’s main B2B product, which averages $22,000 per contract.

“I don’t want to leave money on the table,” he says, “but buyers won’t pay, sellers definitely won’t. So where’s the budget? It’s in reducing overtime costs.”

Security That Evolves With Threats

The company’s approach to security extends beyond wire fraud protection. “We’ve moved beyond SMS multi-factor authentication,” Tomaszewski notes. “We use Google Authenticator following federal recommendations against SMS.”

The system is designed to be intuitive, with visual indicators helping users identify potential issues. “We’re implementing color indicators. Green means everything’s good, yellow means verify, red means stop everything and call before proceeding.”

The Future: Scaling Security For All Real Estate Transactions

If the pilot proves successful, Tomaszewski sees enormous potential. “This can benefit every home buyer in the US,” he says. “It’s a cost-effective alternative to cashier’s checks, which many people aren’t familiar with and require visiting a bank before closing time.”

For real estate professionals, the solution offers a way to protect clients during one of the most vulnerable moments in the transaction process. Tomaszewski envisions partnerships with brokers who can advocate for the solution with their preferred law firms.

What distinguishes RedlineDCS’s approach is its recognition that purely digital solutions have limitations. “Digital security alone can’t anticipate all hacker tactics,” Tomaszewski observes. “A printed, sealed envelope may be the most effective authentication method available today.”

As the pilot program concludes, Tomaszewski is gathering comprehensive feedback to determine next steps. The timing could be advantageous, with the real estate market showing signs of increased activity. “There’s significant pent-up demand,” he notes. “Many are waiting to transact when market stability returns.”

“Everyone knows someone who’s experienced wire fraud,” Tomaszewski says. “It’s remarkably easy to fall victim, even when you’re vigilant.”

This article was sourced from a live expert interview.

Every month we conduct hundreds of interviews with

active market practitioners - thousands to date.

Similar Articles

Explore similar articles from Our Team of Experts.

Arkansas offers a distinctive environment for real estate, where legal knowledge plays a direct role in property transactions. Jerry Larkowski, Executive Broker at ESQ Realty Group, exemplif...

Buying your first home is often more complex than expected. Instead of a straightforward process, you may find yourself managing paperwork, strict deadlines, and multiple parties you didn’...

Real estate agents in Connecticut’s fix-and-flip market are increasingly competing on operational and financial expertise rather than sales ability alone. Some agents are providing investo...

The real estate industry has witnessed a significant shift in how professionals build their personal brands and connect with high-value prospects. While traditional marketing methods continu...