The real estate market in the DC metro area is shifting focus toward Virginia, with investors and buyers increasingly drawn to the state’s business-friendly environment and technology sect...

In Manhattan’s commercial real estate market, conventional wisdom suggests that national credit tenants are the safe bet for recovery. But Showket Ahamed of Helmsley Spear, who built his own career from bootstrapped beginnings, sees a different path forward – one led by ambitious local enterprises and emerging entrepreneurs who could drive the market’s next phase.

“Every landlord and broker tries to find national tenants or credit tenants,” notes Ahamed, who started his real estate journey as a loan officer before working his way up through various sectors. “But they often ignore the mom-and-pop shops, the dreamers who want to start a business.”

This perspective, he suggests, misses a crucial opportunity. Drawing from his own experience of building relationships from the ground up – starting as a loan officer at Countrywide Home Mortgage and learning the business one conversation at a time – Ahamed has found success by looking beyond traditional profiles. He recalls spending his early days sitting beside an experienced underwriter named Laura Lane, buying her lunch and absorbing every detail he could about the business. That dedication to learning and relationship-building transformed him from a newcomer into a top producer.

After navigating the 2008 financial crisis, he made the leap to commercial real estate, where a mentor named Paul Stern gave him a chance despite initial reservations. “He looked at me and said ‘something about you I like and something about you I don’t like,'” Ahamed recalls. “‘You’re hungry and desperate… but you go so fast.'” It took eight months to close his first deal, but that patience and persistence paid off. Now at Helmsley Spear, he brings that same appreciation for ambitious strivers to his work with tenants.

“I’m a people person. I’d rather work with dreamers than big guys like Amazon or other major companies that everyone has,” he explains. “These entrepreneurs often bring energy and innovation that can strengthen a property.” His own journey from newcomer to industry veteran has given him unique insight into recognizing potential in unexpected places.

The key to working with emerging businesses lies in education and relationship building. “You have to educate landlords about these tenants’ financial strength,” Ahamed explains. “Sometimes they might not speak perfect English, but they’re very smart and educated. Setting up meetings helps landlords understand the person behind the business.”

His recent successes – including deals on 39th Street between Seventh and Eighth Avenues, and another on 57th Avenue near Times Square – demonstrate how smaller tenants can thrive in premium locations when given the chance. “You have to analyze the problem, gather information, and guide both sides through the process,” he explains. “Many of these tenants are financially very strong – they will pay rent on time. But you have to help the landlord understand that.” These experiences suggest that traditional metrics for evaluating tenants might need updating in today’s market.

Forward-thinking landlords are finding that adapting spaces to support growing businesses can yield unexpected benefits. Recent innovations include:

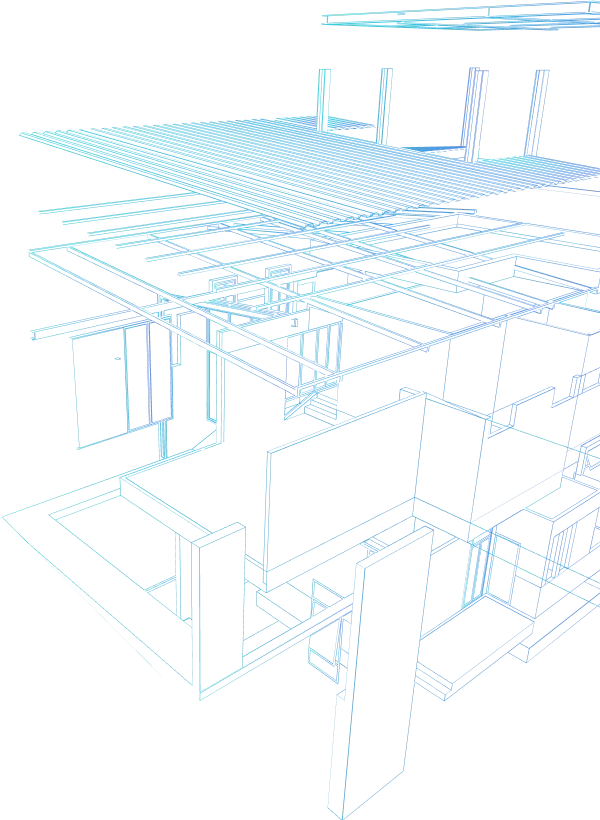

“Some major projects, like the development on 23rd and 10th Avenue, are reimagining how spaces can be used,” Ahamed notes. “It’s about creating environments where innovation can happen naturally.”

What’s particularly striking about Ahamed’s perspective is how it connects human elements to market recovery. “You can’t create something on Zoom in main street America – it never happens, never going to happen without collaboration,” he emphasizes. This insight suggests that properties supporting genuine collaboration and community might find themselves at the leading edge of recovery.

“Companies are investing in making people excited to be there, creating something new,” Ahamed observes. The most successful properties are those that facilitate connection – whether through regular events, collaborative spaces, or amenities that encourage interaction.

While Manhattan’s office market continues to evolve, some of the most promising signs of recovery are coming from unexpected places. Small businesses and local entrepreneurs, rather than being high-risk tenants, might actually represent the market’s most resilient segment – bringing energy, innovation, and sustainable growth to properties willing to take a chance on them.

“This is Manhattan. This is New York. Things happen,” Ahamed reminds us. “We’re still going to be here.”

For landlords and brokers navigating today’s market, opportunity often lies beyond conventional metrics. Those combining sound fundamentals with openness to emerging businesses are discovering that the strongest tenants frequently mirror New York’s enduring entrepreneurial spirit.

Every month we conduct hundreds of interviews with

active market practitioners - thousands to date.

Explore similar articles from Our Team of Experts.

The real estate market in the DC metro area is shifting focus toward Virginia, with investors and buyers increasingly drawn to the state’s business-friendly environment and technology sect...

After a difficult 2023, the commercial real estate lending market has rebounded. Lenders are actively competing for deals again, and transaction volume has surged. However, according to Bran...

Manhattan’s retail landscape continues to evolve in ways that challenge conventional wisdom about the future of brick-and-mortar shopping. While shopping malls struggle nationwide and ...

When Intel announced its multi-billion-dollar semiconductor facility in Licking County, Ohio, the impact quickly spread beyond the factory’s footprint. Neighboring townships, once expectin...

Small-lot industrial development has been systematically abandoned by major developers, creating artificial scarcity in a critical market segment. The Richmond metro area just delivered its ...

The Manhattan office market has undergone a rapid and unexpected change over the past year, with rents for top-tier buildings rising much faster than anyone predicted. Class A properties are...