For years, analyzing real estate deals was a slow and often skipped process for many investors. Manual comping—reviewing comparable sales to estimate a property’s value—typically took ...

Data-Driven Transparency in Vacation Rental Management: Brooke Pfautz's Industry Innovation

“Sunlight is the ultimate disinfectant,” says Brooke Pfautz, founder of Comparent, as he explains his mission to bring transparency to the vacation rental industry. With a spotlight logo symbolizing his commitment to “shining a light in dark corners,” Pfautz is transforming how property owners find managers and how quality property managers get discovered.

From Financial Crisis to Industry Disruptor

Pfautz’s journey into vacation rentals began with the 2007 financial crisis, which wiped out his successful mortgage banking firm in the DC-Baltimore area.

“I pretty much lost everything,” Pfautz recalls. But opportunity emerged through his network in the Young Presidents Organization (YPO). A fellow member approached him with an unexpected proposition: “He said, ‘Hey, Brooke, I’ve had this idea to start a short-term rental company, and I want you to be my business partner. I’ll put all the money into it, and you build and run this thing.'”

Despite having virtually no experience with vacation rentals, Pfautz embraced the challenge. “I said, I appreciate the confidence but I know nothing about short-term rentals other than staying in one once. He goes, ‘Brooke, you’re an entrepreneur, you’ll figure it out.'”

That leap of faith paid off. Starting in October 2007, Pfautz grew Vantage Resort Realty from zero to 500 properties in just five years before selling it in 2013. After serving as Chief Business Development Officer for a major Orlando property management company, he launched Vintory.com in 2019, a platform helping professional vacation rental managers grow their inventory.

The Pandemic Pivot

When COVID-19 hit in March 2020 his fledgling company faced an existential threat. “Over the next month, I had about half my customers cancel. We weren’t selling anything either,” he remembers. For a month, Pfautz feared his new venture would collapse right when it started gaining traction.

Then came an unexpected reversal. “It was exactly one month later, April 16, like something hit. The floodgates opened up, and it went the exact opposite,” Pfautz says. “It was just pure chaos for the next two or three years, crazy growth. We were doubling and tripling every single year.”

This experience reinforced a crucial lesson: “Every seven to ten years, there’s some kind of black swan event. In 2001 it was 9/11. In 2007-2008 it was the financial crisis. In 2020, you had COVID.” He also points to regional disruptions like the Maui wildfires and the BP oil spill that devastated local vacation rental markets. “The only thing for certain is some sort of black swan event will happen.”

Leveling the Playing Field with Data

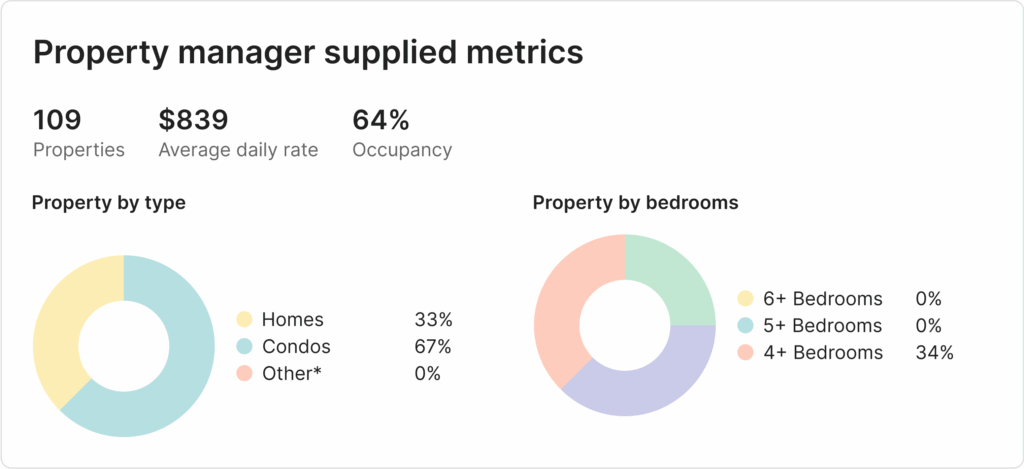

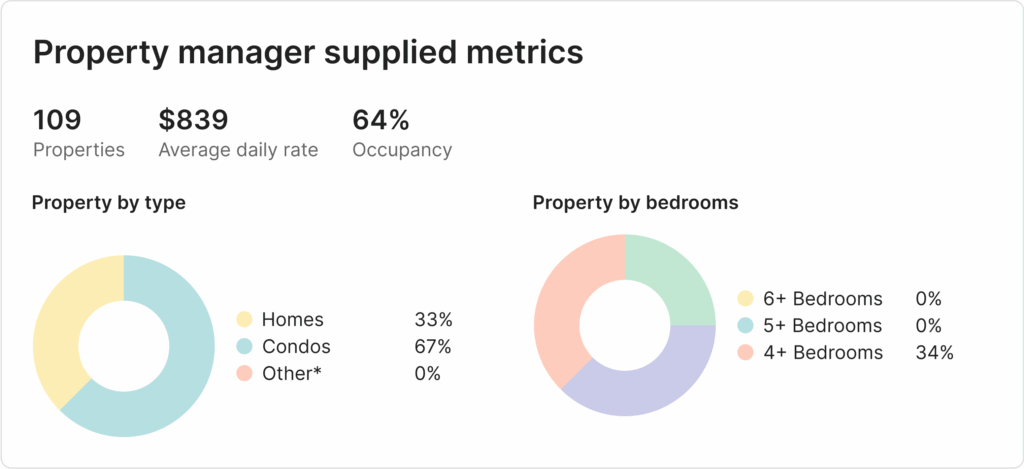

Two years ago, Pfautz launched Comparent.com to address a fundamental problem in the vacation rental industry: the lack of transparency in the property management selection process. The platform now lists over 6,000 companies and serves as the largest marketplace connecting vacation homeowners with professional managers.

“This is not a novel concept,” Pfautz explains. “This has been done in every other vertical out there. It’s just not been done in the short-term rental industry.” Drawing inspiration from platforms like Capterra, G2, and Yelp, Pfautz created a marketplace that levels the playing field between small, high-quality operators and large, venture-backed companies with massive marketing budgets.

He cites Steven Chrobak of Myrtle Beach Destinations as a perfect example: “He has an incredible company with five-star reviews across the board. He outperforms his competition by 20-25% in revenue, but nobody knew about him. He’s a 20-something-year-old, and people would sign up with these large venture-backed companies instead.” Through Comparent, Chrobak has since signed seven new homeowners directly attributed to the platform’s visibility.

The Broken Property Management Selection Process

For property owners, finding the right management company has traditionally been frustrating. Pfautz’s team secret-shopped 100 property managers and discovered alarming results: “They only picked up the phone 34% of the time. When we left a message, they only called us back 57% of the time, which means the vast majority of people reaching out don’t get a hold of anybody.”

Pfautz understands this frustration firsthand. “I have my own property in Bethany Beach, Delaware. Two years ago, I was at my niece’s engagement party when a guest called about an overflowing toilet. I spent the entire party in my car trying to get a plumber out there.”

Such experiences highlight why many individual owners eventually seek professional management. “Many people who purchased vacation properties initially thought, ‘I can just list it on Airbnb. It’s easy and fun.’ They quickly realize how difficult it is.”

Data Reveals the Industry’s True Leaders

Comparent recently announced its Market Leaders Awards, recognizing top-performing vacation rental management companies across the United States. The rigorous selection criteria included maintaining at least a 4.5-star average guest review score across multiple platforms, having at least seven positive homeowner reviews with at least 4.5 starts or greater, managing at least 10 properties in a specific market, and maintaining a complete profile.

Out of over 6,000 companies, only about 45 qualified as Market Leaders. These elite companies collectively manage over 14,000 properties, generate approximately $1.2 billion in annual revenue, and maintain an average review score of 4.75 across more than 300,000 reviews.

Interestingly, most Market Leaders are mid-sized operations managing between 50 and 200 properties, rather than the industry’s largest players. “Some of the larger companies did not make it,” Pfautz notes, mentioning that neither Vacasa nor Evolve qualified.

The data revealed that smaller companies like Myrtle Beach Destinations and Curate Telluride (with 20-112 properties) achieved the highest scores of 99+, while mid-sized companies like Moving Mountains and Bluewater Vacation Homes (150-250 properties) scored in the 98 range. One notable exception was AvantStay, which achieved a 96.7 score despite being the 11th largest management company in the U.S.

The Future: Bringing Transparency to Vacation Rental Technology

Pfautz is now expanding Comparent’s mission to the software and technology that powers the vacation rental industry. “Mark Andreessen wrote an article over ten years ago that said, ‘Software is eating the world.’ And he was spot on,” Pfautz says. “In the future, there will not be software companies and non-software companies; all companies will be powered by technology.”

The vacation rental industry exemplifies this evolution. “When I first got in this space, I remember meeting somebody that kept all their calendars on a dry erase board,” Pfautz recalls. “Now every vacation rental management company has dozens of software applications.”

To help companies navigate this increasingly complex landscape, Comparent recently conducted “the largest survey ever done in our space,” with over 600 companies responding about their technology stack. Within the next 30 days, Comparent plans to publish these findings and launch a comparison site for vacation rental technology.

“Just like what we did for helping vacation rental homeowners find professional managers, we’re creating a website that makes it easy to shop and compare software for your short-term rental company,” Pfautz explains.

This expansion reflects Pfautz’s core philosophy: “We’re shining a light in the dark corners to provide information to make buying decisions easier.”

This article was sourced from a live expert interview.

Every month we conduct hundreds of interviews with

active market practitioners - thousands to date.

Similar Articles

Explore similar articles from Our Team of Experts.

The commercial real estate industry has long been characterized by its resistance to technological change, with many firms managing multi-million dollar portfolios through the same spreadshe...

The traditional real estate transaction process has remained largely unchanged for decades, but technology-driven platforms are beginning to change how properties change hands. One company a...

In an industry where miscommunication and mistrust often define the relationship between homeowners and contractors, Block Renovation is creating a paradigm shift. Led by CEO Julie Kheyfets,...

When Jeff Cheung attended Harvard Graduate School of Design, he wasn’t just pursuing another degree – he was searching for answers to California’s escalating housing crisis. To...