The Austin real estate market is experiencing a notable shift as the post-pandemic boom settles into a more measured pace, with buyer hesitancy emerging as a defining characteristic. After y...

“The biggest things we’re seeing in the market right now are a drive towards stability,” notes Izzy Cannell, Workplace Insights Lead at VergeSense. “Companies are moving toward more rapid decision making than we’ve seen in recent years, with growing confidence in their space planning decisions.”

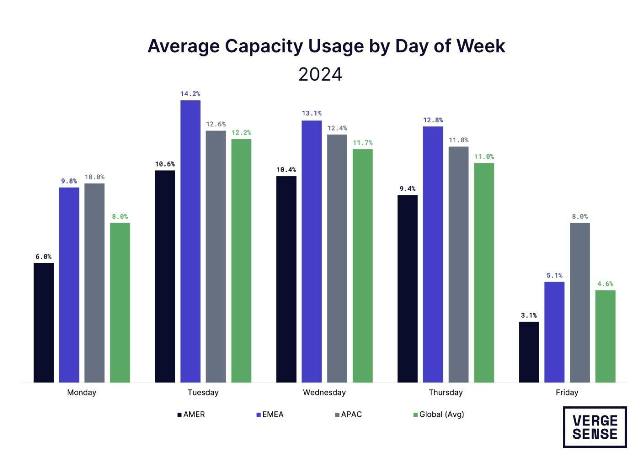

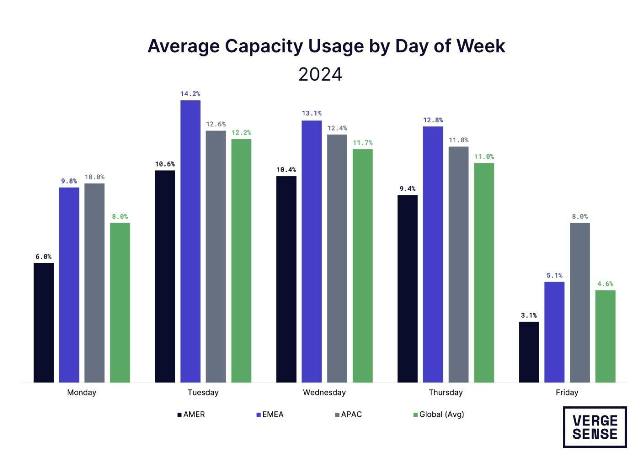

Five years after the pandemic dramatically altered workplace attendance, understanding precisely how office space is being used has become critical for real estate professionals and investors. VergeSense’s recently released Occupancy Intelligence Index brings clarity to these trends through detailed utilization data collected across global markets.

What sets VergeSense’s approach apart is its multi-layered data collection methodology. “We have coverage through our sensors, both from an entry-exit standpoint, as well as space measurement,” Cannell explains. “We measure what is going on within specific spaces, but we also measure overall in and out.”

This system combines physical sensors with Wi-Fi data to create a comprehensive picture of space utilization. With information from over 200 companies spanning the Americas, EMEA, and APAC regions, the index provides a global perspective on emerging workplace patterns.

Despite early predictions about the permanent death of office work, the data tells a more nuanced story. “What a mandate is, is just an attendance policy,” Cannell states. “It’s how we work. It’s the way we’re working. And we’ve always had them.”

These attendance policies are creating distinct patterns:

“We’ve had some more vocal businesses coming out about their returns in four or five days,” Cannell notes. “The financial industry certainly is one of them, and we are seeing change in the utilization for those spaces.”

Perhaps the most valuable insight for real estate professionals is the identification of a fundamental mismatch between office design and actual usage patterns.

“In many offices, there’s a high supply of desks that aren’t fully utilized,” explains Cannell. “The bottlenecks we’re seeing aren’t at the desks, but rather in conference rooms and enclosed spaces for collaboration. That’s where demand exceeds supply.”

This disconnect creates a strategic opportunity for property owners and managers to reconsider space allocation. Companies are increasingly focused on understanding:

For those new to workplace analytics, the raw utilization numbers might initially seem surprisingly low—typically 5-15% depending on the day. Cannell provides context for interpreting these figures:

“When we look at it on the aggregate basis, we are basing this off of the average measurement divided by total seats in the space. So that’ll count desk seats and every seat in a conference room, and the seats in different environments within the space.”

This standardized approach allows for consistent measurement across diverse environments, though individual companies often develop customized metrics for their specific needs. The data also reveals significant regional variations.

“One customer will see very different trends, for example, in their London location versus their Tokyo location versus their Seattle location,” Cannell points out.

With hybrid work firmly established, companies are focusing on creating environments that justify the commute. VergeSense’s data helps identify which spaces deliver the most value beyond simple utilization rates.

“Maybe a certain type of event space is not used as often as our conference rooms, but it’s critical to the employee experience,” Cannell explains. “That becomes that commute-worthy piece.”

This recognition drives different evaluation strategies for various space types:

For commercial real estate professionals, this granular data unlocks new strategic possibilities. The key, according to Cannell, is aligning measurement with objectives:

“The most power really comes from starting with the why—why are we doing things a certain way? What is our policy? What are we trying to accomplish? And that’s when we see our data become the most powerful decision supporter.”

Beyond informing portfolio decisions, these insights can guide:

“How can spaces be more sustainable if we understand how they’re being used?” Cannell asks, highlighting an increasingly important consideration for the industry.

After years of hesitation and uncertainty, VergeSense’s comprehensive data collection suggests 2025 will bring more decisive action in workplace strategy. The pandemic-induced paralysis that has gripped many organizations appears to be lifting as utilization patterns stabilize and clearer trends emerge.

“There’s been so much indecision, unknown and analysis paralysis in the last four or so years,” Cannell reflects. “This year, I am excited to see more of that confidence come into the decisions.”

This renewed confidence is manifesting in several ways. Property managers are reconfiguring spaces based on actual utilization data rather than assumptions. Corporate real estate teams are making more definitive long-term leasing decisions. And workplace strategists are designing environments that specifically address the demonstrated needs of their workforce.

For CRE professionals, leveraging this detailed utilization data will be essential for portfolio optimization and strategic planning. The ability to make data-driven decisions about space allocation, building operations, and long-term investments provides a significant competitive advantage in an evolving market.

As Cannell and the VergeSense team continue to refine their analytics capabilities, the resulting insights promise to bring greater certainty to an industry that has weathered significant disruption. By transforming raw utilization data into actionable intelligence, they’re helping to shape the next generation of workplace environments that better serve both organizations and the people who work within them.

Every month we conduct hundreds of interviews with

active market practitioners - thousands to date.

Explore similar articles from Our Team of Experts.

The Austin real estate market is experiencing a notable shift as the post-pandemic boom settles into a more measured pace, with buyer hesitancy emerging as a defining characteristic. After y...

The Texas residential market is experiencing a fundamental shift as inventory levels climb 35% and traditional market patterns evolve. For cash buyers and real estate investors, these change...

PARKSVILLE, British Columbia, July 17, 2024 (GLOBE NEWSWIRE) — Today, the Rental Protection Fund (the Fund) and the Province of British Columbia announces the acquisition of 50 afforda...

“With fewer new homes being built due to economic headwinds, the market for existing homes becomes increasingly important,” explains Patrick Hayes, General Manager at Colibri Gro...

4610 Makena Road, Wailea-Makena, Hawaii Rare beachfront trophy estate on Maui’s southwest coastline A private tropical haven with two gated entrances and private access Seamless indoor and...

While residential housing markets have drawn attention for price corrections and inventory concerns, Cape Coral’s land market tells a different story that points to underlying economic res...