The global real estate market represents the world’s largest asset class at $654 trillion, generating $18 trillion in annual transactions. Yet despite its massive scale, it remains wha...

Streamlining the Retrofit Pipeline: Cadence OneFive's Data-Driven Approach to Building Upgrades

“Tech is new for the sake of new. Real Estate is old for the sake of old,” observes Marc Zuluaga, co-founder and Chief Revenue Officer of Cadence OneFive. This tension between innovation and tradition lies at the heart of the challenge his company is working to solve in the building energy retrofit space.

Founded three years ago by industry veterans Zuluaga and Bomee Jung, Cadence OneFive represents a new approach to building energy efficiency. The company combines public data and standardization to transform how building owners tackle retrofit projects.

Their platform serves as a marketplace, bridging critical gaps in the industry. It connects building owners with capital providers and qualified contractors – creating a more streamlined pathway to implementation. This innovation comes at a crucial moment, as regulatory pressure and climate concerns make building upgrades increasingly urgent.

Turning Public Data into Actionable Intelligence

One of the company’s key innovations is their approach to categorizing buildings. While New York City has around a million structures, Zuluaga explains that there are really only “10 to 20 typologies – repeatable typologies that capture 90% of the market.”

This insight drives Cadence OneFive’s rapid assessment capabilities. “The pre-war building with steam heat that’s less than six stories is actually the single most common typology in New York City,” notes Zuluaga. By recognizing these established building patterns, the platform can quickly analyze properties and deliver targeted retrofit recommendations suited to each building’s specific characteristics.

The company combines public benchmarking data from cities like New York and DC with their building science expertise to create what Zuluaga describes as “an x-ray, like an instant energy audit” of buildings. This allows them to identify which buildings are using more carbon-intensive fuel sources, which have the least efficient systems, and which are the best candidates for specific types of retrofits.

The platform’s effectiveness is evident in the numbers. For example, when analyzing Con Edison’s multifamily building portfolio – spanning over 2 billion square feet – the system identified that nearly 40% of pre-war buildings still using steam heat could achieve 20-30% energy savings through standardized retrofit packages.

Bridging the Implementation Gap

While the technology is impressive, Zuluaga acknowledges that the biggest challenge isn’t technical – it’s human. In the day-to-day reality of real estate operations, energy retrofits often take a back seat to more immediate concerns. “Unless there’s a fire, unless it’s the thing at the top of the pile, there’s 17 other things in real estate that are going to be more important,” he explains. This prioritization challenge is especially acute for building operators, who face constant demands on their attention. As Zuluaga notes, “Everyone understands. Everyone knows it’s out there, and knows they have to do something about it,” but with so many competing priorities, energy upgrades often remain on the back burner.

Recognizing these challenges, Cadence OneFive is trying to reduce friction and make implementation easier with its marketplace approach. The platform connects building owners with capital providers offering low-interest financing and rebates, while also matching them with qualified contractors for specific project scopes. “Making it as easy as possible for folks to get started is part of what we’re trying to solve,” says Zuluaga.

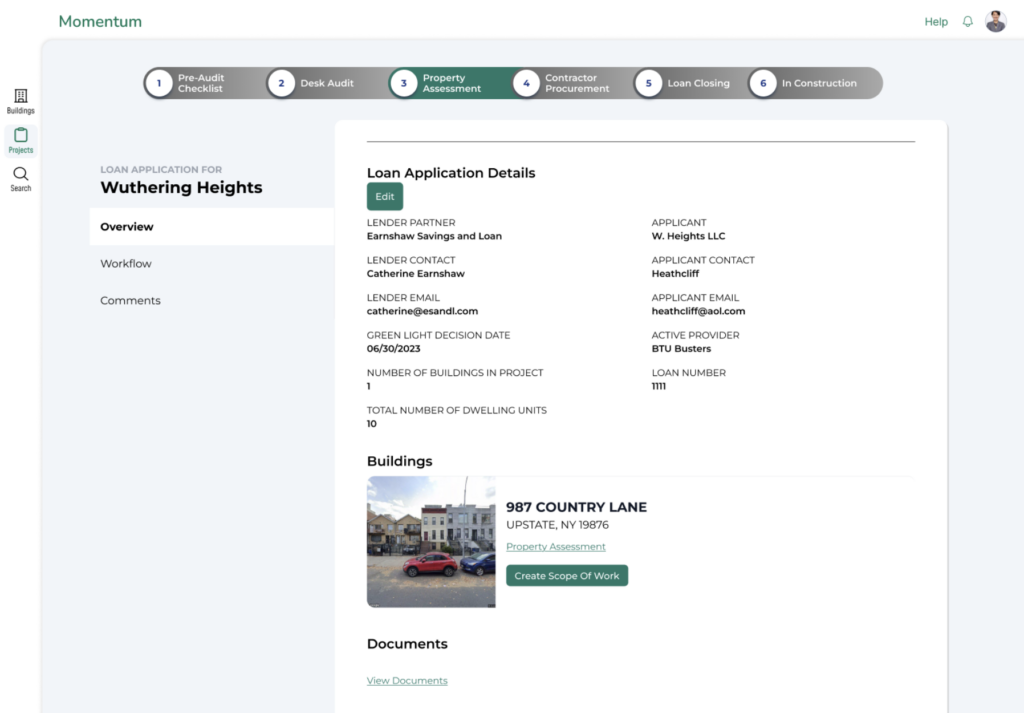

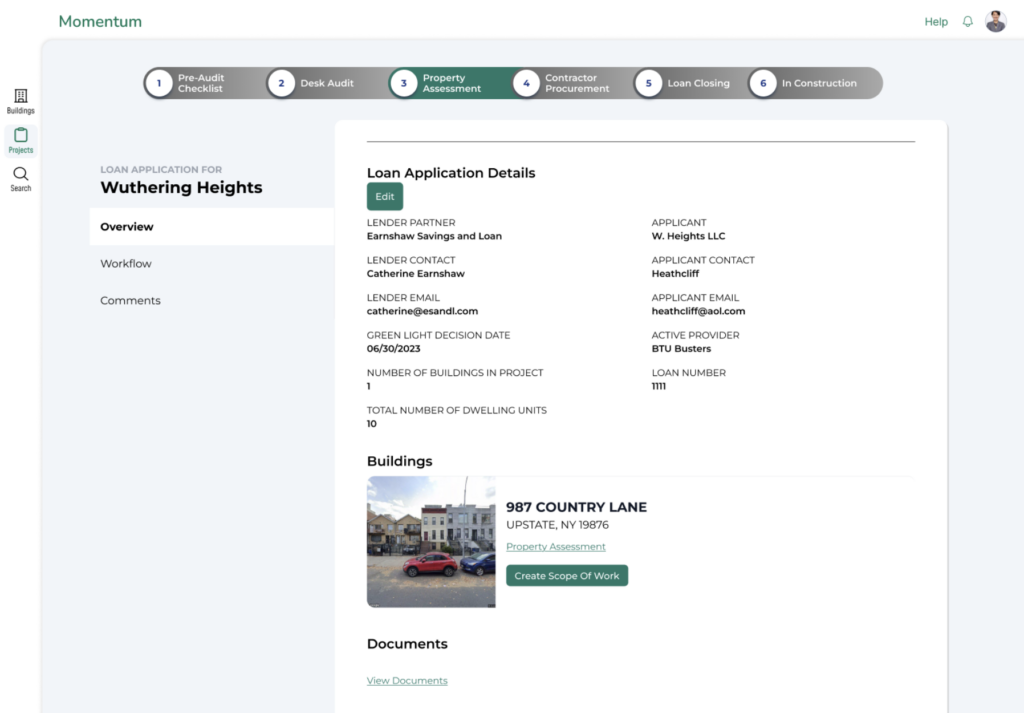

The platform’s standardized approach has already shown promising results. Buildings moving through NYS’s flagship 250M “Climate Friendly Homes” multifamily electrification program are able to progress from initial program intake application to preliminary heat pump retrofit scope development in one week, a 4-5x increase over business as usual manual processes.

Market Forces Driving Change

Several factors are converging to drive increased interest in building retrofits. Zuluaga describes it as a “push and pull” dynamic: “The carrots are the resources in terms of low-cost money if you do certain green things, or straight-out grants and rebates… and then it’s the stick of the local building performance standards.”

In New York City, Local Law 97’s looming deadlines are forcing building owners to take action. But Zuluaga notes that the conversation is evolving beyond just carbon reduction, particularly in the affordable housing sector: “The buildings that are most rent-burdened are the same buildings that have high carbon footprints, are the same buildings with more hospital visits due to asthma… You can’t go into certain communities talking about carbon when really their roof is leaking.”

For perspective, Local Law 97 will affect roughly 50,000 buildings across New York City – any building over 25,000 square feet. Data from Cadence OneFive’s platform shows that approximately 75% of these buildings will need to implement some form of energy retrofit to meet the 2024-2029 emissions limits, with the average project cost ranging from $200,000 to $1.5 million depending on building size and current emissions profile. The company’s analysis indicates that buildings taking early action are securing financing at rates 2-3 percentage points lower than market average, while also positioning themselves to capture federal and state incentives that could offset up to 30% of project costs.

Looking Ahead

As climate impacts become more apparent, Zuluaga sees the retrofit market only growing. “Money is going to get spent in these buildings, increasingly over the years, for a variety of reasons,” he notes. “Whether it’s for reducing carbon footprint or ultimately adapting these buildings to changing climates.”

The company has been proving out their model in New York City – which represents 10% of the national multifamily building market – and is now expanding to other major metro areas. Outside of NYC, they are looking to identify 5-10 portfolio owners or managers to get one year free access to the platform in exchange for feedback to inform the continued build out. Please email Marc directly about this at [email protected].

This article was sourced from a live expert interview.

Every month we conduct hundreds of interviews with

active market practitioners - thousands to date.

Similar Articles

Explore similar articles from Our Team of Experts.

In an era where digital transformation is reshaping property management, brokerage operations, and client acquisition strategies, the team at iCloudReady are pioneering comprehensive PropTec...

The Austin real estate market is entering a new phase as buyers grow impatient with high interest rates and sellers face pressure to price homes in line with current market conditions. This ...

The Pensacola real estate market is experiencing a notable shift from the seller’s market of recent years to a more challenging environment where inventory levels have reached new high...

The New Jersey Shore real estate market is experiencing persistent buyer activity, driven by migration from higher-cost areas, particularly New York. This influx is reshaping pricing and inv...