For Mike Speciale, what started as a job selling building materials—lumber, doors, and windows—has evolved into a 26-year journey as one of Austin’s notable developers. As the Owne...

From Coast to Heartland: AirDNA Reveals New Short-Term Rental Investment Frontiers

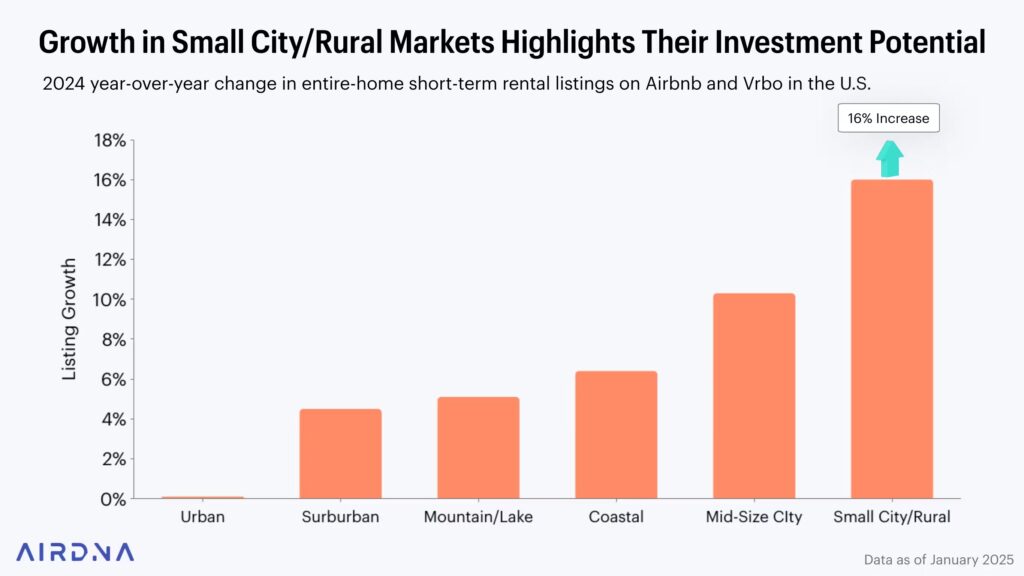

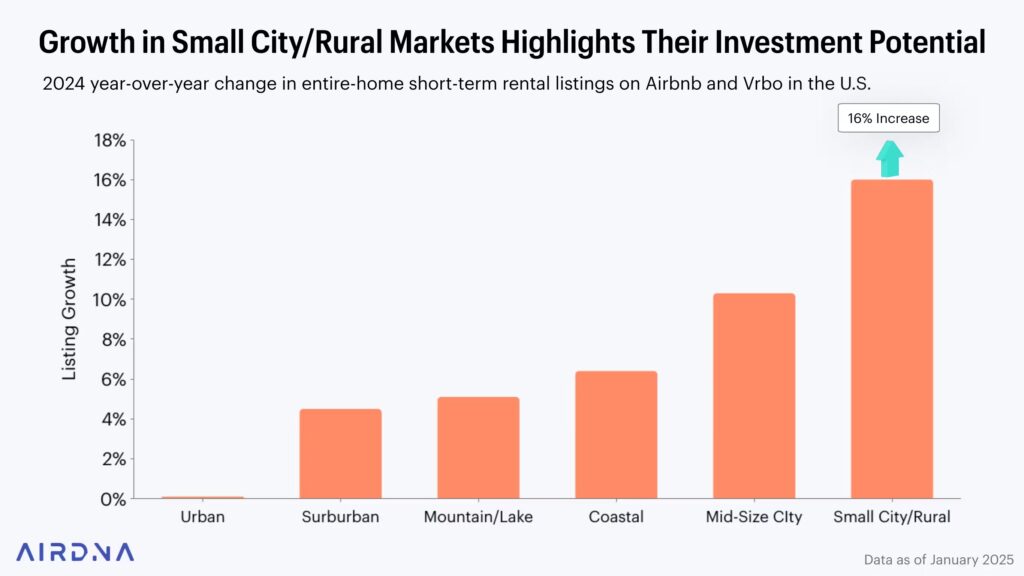

After years of volatility in the short-term rental (STR) market, 2024 marked a significant turning point toward stabilization, with emerging opportunities in unexpected markets across the United States, according to AirDNA’s 2025 Best Places to Invest report.

The report, now in its tenth year, reveals a continuing shift away from traditional coastal and mountain destinations toward small and mid-sized markets, where lower property values and strong occupancy rates are creating compelling investment opportunities.

New Data-Driven Investment Framework

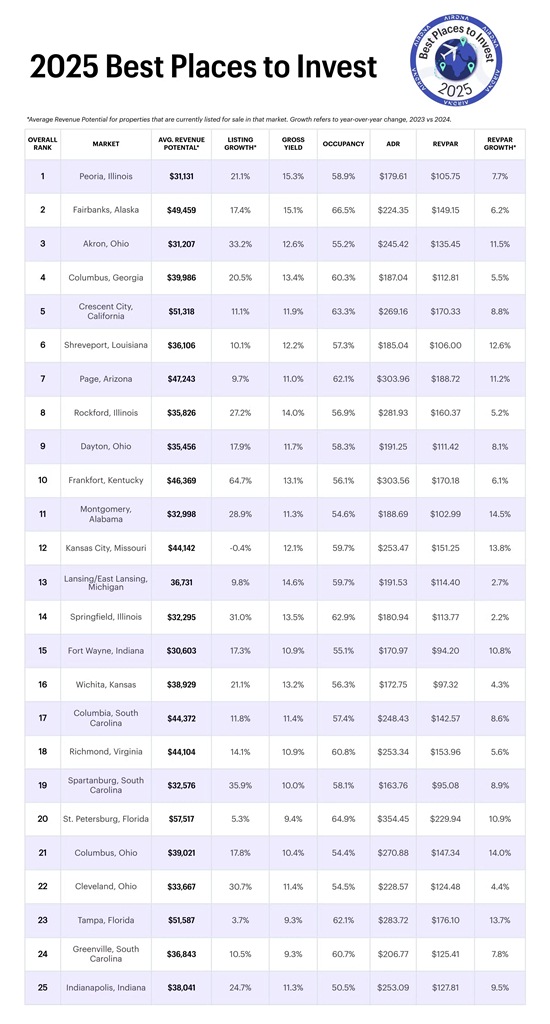

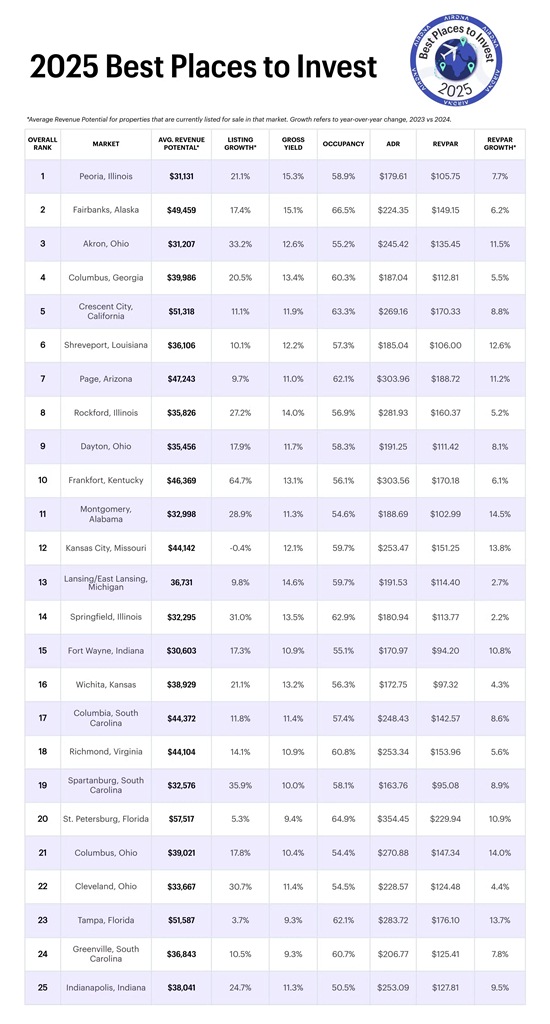

To identify genuine investment opportunities in today’s market, AirDNA has revolutionized its methodology for its tenth annual report. Moving beyond market-wide averages, the company analyzed 500,000 homes currently for sale, focusing on properties between $100,000 and $5 million that are zoned for short-term rental use.

“Historically, we’d essentially taken the average home value for a market and the average earning potential,” explains Jamie Lane, Chief Economist at AirDNA. “But with today’s low inventory, we heard that our list was great, but there were no properties actually available in those markets.”

The analysis weighs three key metrics:

- Investability (50%): Based on potential yield from currently available properties

- Rental demand (25%): Measuring actual nights booked versus available nights

- Revenue momentum (25%): Tracking RevPAR (Revenue Per Available Rental) growth trends

Small Markets, Big Returns

The 2025 report identifies several standout markets where investors can find strong returns. The table below highlights the top five markets leading the way in short-term rental investment opportunities.

Using this refined approach, the 2025 report highlights cities like Peoria, Illinois, Fairbanks, Alaska, and Akron, Ohio among the top markets for STR investment. These emerging destinations are benefiting from several key factors, including lower property acquisition costs and growing leisure travel demand.

Lane points to Kentucky’s Bourbon Trail as an example of this trend: “It’s not a popular place for people to be moving to right now, but it’s a very popular place for people to be traveling to and looking to short-term rentals as a place to accommodate them where there’s not a lot of hotel inventory.”

This opportunity is further amplified by the current challenges in hotel development. While small and mid-sized cities are seeing robust STR supply growth of 10-15%, “It’s almost impossible to finance new hotel investment right now,” Lane notes, “and it’s about three times as challenging to do it outside of the top 25 markets. No bank is willing to put up that money right now.”

Market Stabilization and 2025 Outlook

The industry’s stabilization is evident in moderating supply growth, which has settled at approximately 4% after dramatic fluctuations in recent years. This equilibrium with demand growth has helped stabilize occupancy rates and restore pricing power, with average prices increasing 2-3% in 2024, tracking with inflation.

After a 20% supply drop in 2020 and subsequent 25% surge in 2022, the market is showing signs of sustainable balance. Looking ahead to 2025, supply growth is expected to remain moderate through mid-year, with a potential uptick in the latter half following recent interest rate cuts.

Investment Approaches and Financing

For investors, conventional mortgages remain the primary funding mechanism, especially for the majority of hosts operating one or two properties. Lane speaks from experience, having purchased his first short-term rental property in 2024 near Helen, Georgia. “I was able to secure the ADRs that Helen commands, but at a lower property cost by being 20 minutes outside the city,” he explains.

For those expanding their portfolios, DSCR loans based on property income potential remain an option, though their popularity has decreased due to high interest rates.

Looking Ahead

The shift toward small and mid-sized markets appears sustainable, particularly with hotel construction expected to remain below long-term averages for the next five years. This continued constraint on traditional accommodation supply, combined with growing leisure travel demand in emerging destinations, suggests enduring opportunities for investors who can identify undervalued markets and properties.

For the short-term rental industry, 2025 marks not just a return to stability, but a fundamental reshaping of the investment landscape. Success increasingly depends on investors’ willingness to look beyond conventional vacation destinations to America’s emerging leisure markets, where lower property values and strong demand create compelling opportunities for returns.

Similar Articles

Explore similar articles from Our Team of Experts.

In real estate finance, Northwind Group stands out for its strategic adaptability. Founded by Ran Eliasaf, a former Israeli Navy captain turned real estate executive, the firm has evolved fr...

In an era where property management is increasingly dominated by large corporations and automated systems, Fort Property Management founder Nathan Harr is championing a return to personalize...

If you’re looking for a smart real estate investment, an Airbnb or vacation rental property may be a lucrative choice. In 2023 alone, more than 448 million Airbnb nights & experiences ...

After years of volatility in the short-term rental (STR) market, 2024 marked a significant turning point toward stabilization, with emerging opportunities in unexpected markets across the Un...