CIRE Equity This business has not yet been verified. Verified status is granted after a short phone interview confirming credentials and professional background.

This business has not yet been verified. Verified status is granted after a short phone interview confirming credentials and professional background.

Lists the geographic locations where this company operates and offers its services, including specific cities, regions, or states.

530 B Street, San Diego, California, United States, 92101

A brief description of the company and its unique selling points, as summarized by KeyCrew.

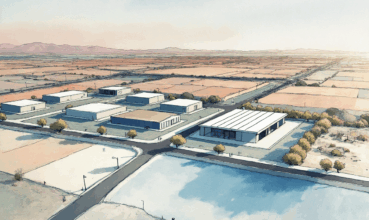

CIRE Equity is a vertically integrated real estate private equity firm that invests in and operates a diversified portfolio of commercial and mixed-use properties, with a focus on delivering stable returns and long-term value for its investors.

This profile was created from KeyCrew's proprietary intelligence platform and human review. To update or correct this information, please schedule a verification interview .