The construction industry’s approach to sustainability is being transformed not by government mandates but by market demands, according to one industry leader who sees efficiency and c...

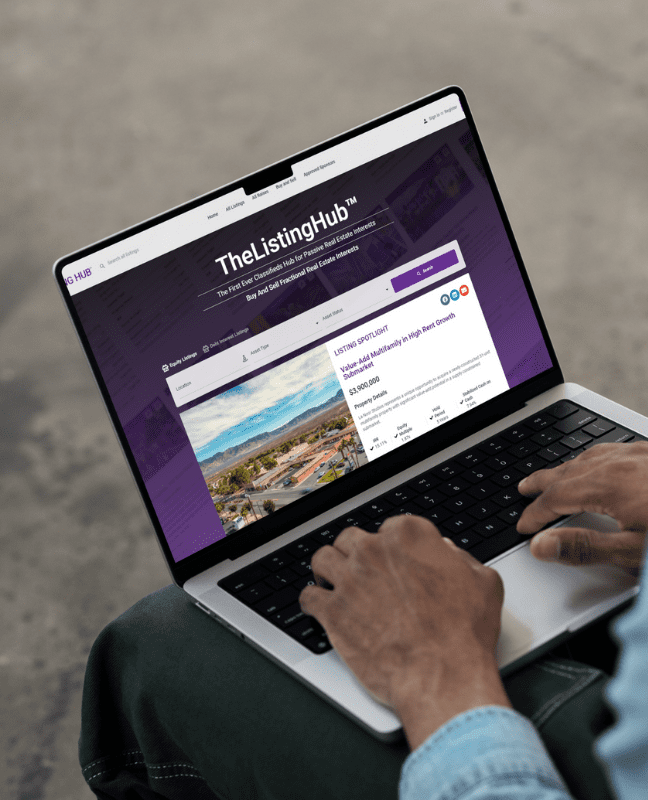

PREIshare Innovates the Landscape of Real Estate Syndication With Liquidity

After syndicating over $7.5 billion in real estate deals and selling his previous company with $1 billion in assets under management, Michael Anderson, Founding Member of PREIshare, could have enjoyed a well-earned retirement. Instead, he’s tackling one of the industry’s most persistent challenges: the lack of liquidity for limited partners in real estate syndication deals. Christion Sadler now serves as the President and CEO.

“What has always concerned me is that sponsor and limited partner interests have never been truly aligned,” says Anderson, reflecting on his 42-year career in real estate syndication. “When I sold my company with plans to retire, this issue continued to trouble me, so I realized I still had unfinished work to do.”

The Fundamental Misalignment

The traditional real estate syndication model creates an inherent conflict between sponsors (syndicators) and their limited partners (LPs). As Anderson explains, “Syndicators prefer to hold real estate indefinitely because it generates continuous revenue streams through property management, asset management, and various other services. Meanwhile, limited partners typically invest for specific goals—perhaps funding their children’s education or improving their lifestyle. They never intended to hold these real estate assets long term.”

This misalignment becomes particularly problematic when investors need access to their capital. Anderson recalls fielding calls from investors facing unexpected financial needs: “My wife is in the hospital, and insurance isn’t covering all her expenses. I’d like to liquidate my assets with you and pay her medical bills. Or frankly, I just want the new Ferrari.”

The standard response from syndicators has always been the same: “You’ve invested in real estate. It’s not liquid.” But Anderson challenges this long-accepted premise: “Truth is, they didn’t invest in real estate. They invested in a Limited Partnership. They own part of a company that owns the real estate. That’s a security, and that should be liquid.”

Creating a Secondary Marketplace

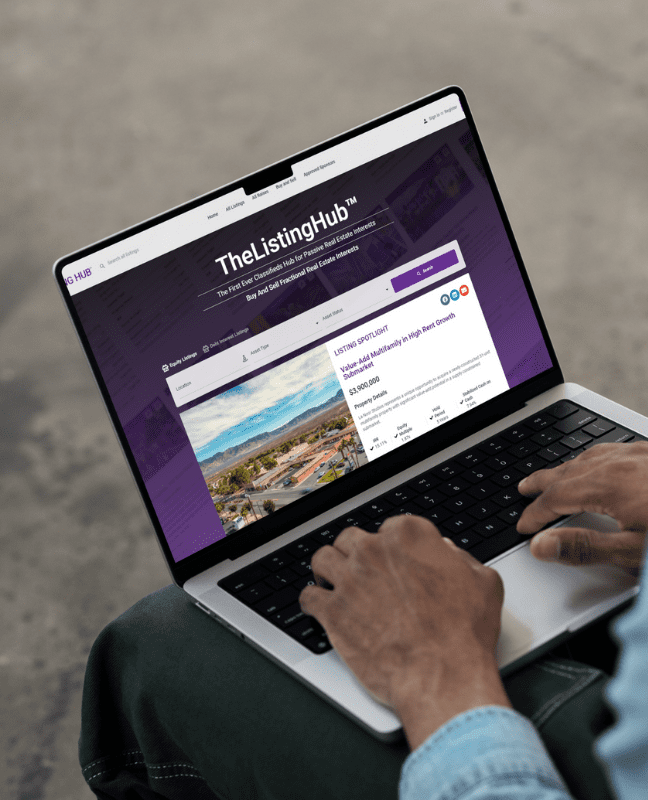

PREIshare’s solution is elegantly simple in concept yet innovative in practice: create a secondary marketplace where LP interests can be bought and sold, providing liquidity to investors while allowing syndicators to maintain ownership of the underlying assets.

“We started with the idea of building a marketplace,” Anderson explains. “We started growing our database of investors already invested in real estate by working with existing syndicators and helping them do their raise. In the process, we helped them change their operating agreements towards ones that would allow investors to move in and out of assets.”

This approach required both legal innovation and technological development. On the legal side, Anderson had to challenge decades of standard operating agreements that explicitly stated investments were illiquid.

“I think there is basically one set of legal documents that govern a syndicated real estate transaction, and all the attorneys just use the same ones and charge you a lot of money like they originated them,” Anderson quips. “All operating agreements and private placement memorandums essentially say ‘You do understand that you’re investing in real estate, and this is not liquid.’ The lawyer didn’t make that up. was That was a rule when I got into the business back in the 70s.”

Regulatory Evolution Creates Opportunity

The opportunity to create this secondary marketplace emerged largely due to regulatory changes, specifically the introduction of Regulation 506(c) during the Obama administration. Before this change, syndicators operated under Regulation 506(b), which required them to have a prior relationship with investors before including them in deals.

“Under REG B, I couldn’t take investment from someone outside the existing investment unless it was somebody I had a prior relationship with,” Anderson explains. “So when someone came to me and said, ‘I need to get out for whatever reason,’ then my options were either to buy it them out myself… or I could offer their share to somebody else in the existing deal. Possibly I could find somebody in my current stable of investors in other projects, but that’s a very limited market.”

The shift to Regulation 506(c) opened up new possibilities: “Now that most everybody’s either doing 506(b) with a (c) or just doing a 506(c), you can go to a broader market. That’s what allowed us to move towards [the listing platform] and being able to sell to the whole world of would-be real estate investors.”

Benefits for All Parties

The introduction of liquidity creates advantages for both syndicators and investors.

For syndicators, it means easier capital raises, since “The syndicators we’re working with say it’s a lot easier to do a raise… When I was doing it, seven out of ten people that were referred to me would start back-pedaling and try to get off the phone as quick as they could once I said, ‘It’s not liquid.’

PREIshare’s model also enables longer hold periods, “The syndicator can hold the real estate indefinitely.” Finally, it opens the door to new investment relationships, “We pick up a brand new investor, new incredible investor that just slotted in, replacing the other one. So that’s just one more person we can work with.”

Advantages for investors align more closely with their financial goals and flexibility. It gives them control over their investment, “They have control of their money, they can get out whenever they want.” And it also gives the opportunity for compounding growth. “If you took that cash out maybe once or twice in that period of time and reinvested it… that return goes to, in that same six-year period, 20-30% or maybe 10x versus 2x over the same period of time.”

The Technology Challenge

While the concept may be straightforward, implementation has proven complex. Anderson candidly admits that building the technology platform has been a significant learning curve.

“When I formed up the team, I hired a bunch of real estate guys and brought them on as partners into it. And come to find out, after about a year, it was clear we’re not really a real estate company. We’re a technology company with real estate as a byproduct.”

This realization led to significant investment in technology development: “We’ve had a tremendous learning curve, I would say. But we’re getting there.”

The platform, called Listing Hub is now in its third iteration and available on both the Apple Store and Google Store. “Finally, we have a solution that is on a bigger, stable, enterprise-grade platform.”

Why Hasn’t This Been Done Before?

Given the clear benefits, it’s fair to ask why the solution took so long to catch on. Anderson attributes it primarily to industry inertia and the regulatory environment.

“I think the big deal obstacle is ‘paradigms.’ For years and years, the preferred tool was the REG B, so it was prior relationship, which meant you had a limited amount of liquidity based on having to have prior relationship, even to do the replacement.”

Even after regulatory changes made broader marketing possible, the industry was slow to adapt: “We’re so ensconced into how to operate a syndication based on Regulation B, 506(b), that we never realized what the possibilities of Regulation C offering meant to us.”

Looking Forward

PREIshare is currently working with approximately 120-130 syndicators, and according to Anderson, the response has been overwhelmingly positive: “The guys that I’m working with, the new syndicators, see the improvement. It’s like ‘the best thing since sliced bread’ in our industry.”

The company’s immediate focus is on education, “Another aspect that I never anticipated is education… Educating the attorneys, educating investors and sponsors that there might be a better tool out there than the one we’re using.”

For Anderson, who now finds himself on the LP side of deals, the mission is personal: “I’ve got a taste of what that feels to be on the other side of the deal. And I’m insisting that anybody I invest with provide me this more liquid option.”

By creating liquidity in a traditionally illiquid market, PREIshare is not only solving a long-standing problem but potentially reshaping the entire real estate syndication industry, making it more accessible, aligned, and ultimately more successful for all participants.

For more information, visit PREIshare.com.

This article was sourced from a live expert interview.

Every month we conduct hundreds of interviews with

active market practitioners - thousands to date.

Similar Articles

Explore similar articles from Our Team of Experts.

The arms race is over. Social media platforms are now actively labeling, filtering, and suppressing AI-generated content, and they’re cross-referencing your claims against actual data....

In the heart of Manhattan’s Financial District, an elegantly curved 60-foot planter with integrated seating catches the eye of passersby. Meanwhile in Stuart, Florida, just north of We...

The real estate industry faces a critical decision point about artificial intelligence that will shape which agents succeed in 2026 and beyond, according to Jeff Quintin, CEO of The Quintin ...

After three decades in design and construction, Michael Miller’s vision for revolutionizing property art displays began in an unexpected place – luxury retail. “I really lo...